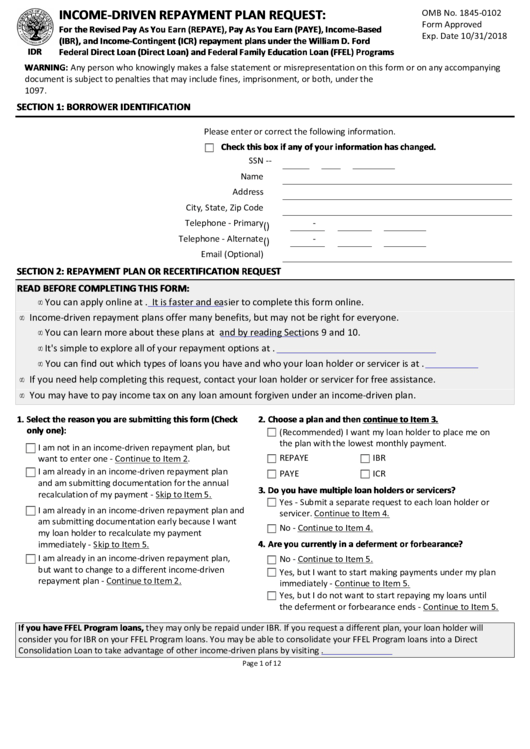

INCOME-DRIVEN REPAYMENT PLAN REQUEST:

OMB No. 1845-0102

Form Approved

For the Revised Pay As You Earn (REPAYE), Pay As You Earn (PAYE), Income-Based

Exp. Date 10/31/2018

(IBR), and Income-Contingent (ICR) repayment plans under the William D. Ford

IDR

Federal Direct Loan (Direct Loan) and Federal Family Education Loan (FFEL) Programs

WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or on any accompanying

document is subject to penalties that may include fines, imprisonment, or both, under the U.S. Criminal Code and 20 U.S.C.

1097.

SECTION 1: BORROWER IDENTIFICATION

Please enter or correct the following information.

Check this box if any of your information has changed.

SSN

-

-

Name

Address

City, State, Zip Code

Telephone - Primary

-

(

)

Telephone - Alternate

-

(

)

Email (Optional)

SECTION 2: REPAYMENT PLAN OR RECERTIFICATION REQUEST

READ BEFORE COMPLETING THIS FORM:

• You can apply online at StudentLoans.gov. It is faster and easier to complete this form online.

• Income-driven repayment plans offer many benefits, but may not be right for everyone.

• You can learn more about these plans at

StudentAid.gov/IDR

and by reading Sections 9 and 10.

• It's simple to explore all of your repayment options at StudentAid.gov/repayment-estimator.

• You can find out which types of loans you have and who your loan holder or servicer is at nslds.ed.gov.

• If you need help completing this request, contact your loan holder or servicer for free assistance.

• You may have to pay income tax on any loan amount forgiven under an income-driven plan.

1. Select the reason you are submitting this form (Check

2. Choose a plan and then continue to Item 3.

only one):

(Recommended) I want my loan holder to place me on

the plan with the lowest monthly payment.

I am not in an income-driven repayment plan, but

REPAYE

IBR

want to enter one - Continue to Item 2.

I am already in an income-driven repayment plan

PAYE

ICR

and am submitting documentation for the annual

3. Do you have multiple loan holders or servicers?

recalculation of my payment - Skip to Item 5.

Yes - Submit a separate request to each loan holder or

I am already in an income-driven repayment plan and

servicer. Continue to Item 4.

am submitting documentation early because I want

No - Continue to Item 4.

my loan holder to recalculate my payment

4. Are you currently in a deferment or forbearance?

immediately - Skip to Item 5.

I am already in an income-driven repayment plan,

No - Continue to Item 5.

but want to change to a different income-driven

Yes, but I want to start making payments under my plan

repayment plan - Continue to Item 2.

immediately - Continue to Item 5.

Yes, but I do not want to start repaying my loans until

the deferment or forbearance ends - Continue to Item 5.

If you have FFEL Program loans, they may only be repaid under IBR. If you request a different plan, your loan holder will

consider you for IBR on your FFEL Program loans. You may be able to consolidate your FFEL Program loans into a Direct

Consolidation Loan to take advantage of other income-driven plans by visiting StudentLoans.gov.

Page 1 of 12

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12