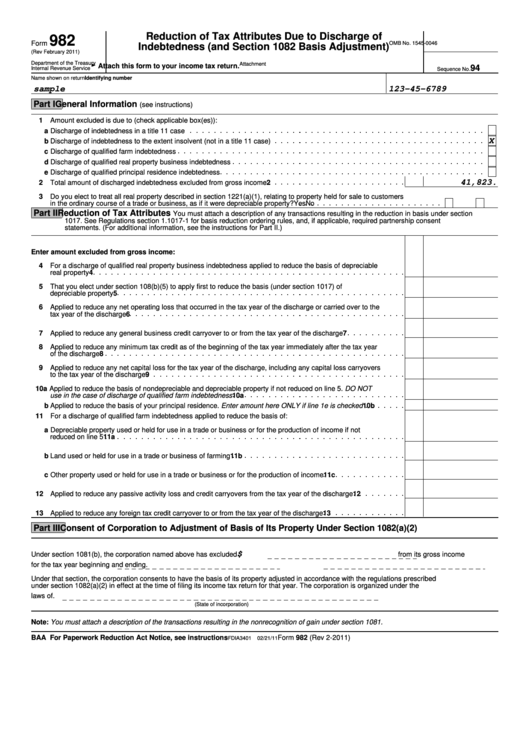

Form 982 - Reduction Of Tax Attributes Due To Discharge Of Indebtedness (And Section 1082 Basis Adjustment)

ADVERTISEMENT

Reduction of Tax Attributes Due to Discharge of

982

Form

OMB No. 1545-0046

Indebtedness (and Section 1082 Basis Adjustment)

(Rev February 2011)

Department of the Treasury

Attachment

G Attach this form to your income tax return.

94

Internal Revenue Service

Sequence No.

Name shown on return

Identifying number

sample

123-45-6789

Part I

General Information

(see instructions)

1

Amount excluded is due to (check applicable box(es)):

a Discharge of indebtedness in a title 11 case

X

b Discharge of indebtedness to the extent insolvent (not in a title 11 case)

c Discharge of qualified farm indebtedness

d Discharge of qualified real property business indebtedness

e Discharge of qualified principal residence indebtedness

41,823.

2

Total amount of discharged indebtedness excluded from gross income

2

3

Do you elect to treat all real property described in section 1221(a)(1), relating to property held for sale to customers

in the ordinary course of a trade or business, as if it were depreciable property?

Yes

No

Part II Reduction of Tax Attributes

You must attach a description of any transactions resulting in the reduction in basis under section

1017. See Regulations section 1.1017-1 for basis reduction ordering rules, and, if applicable, required partnership consent

statements. (For additional information, see the instructions for Part II.)

Enter amount excluded from gross income:

4

For a discharge of qualified real property business indebtedness applied to reduce the basis of depreciable

real property

4

5

That you elect under section 108(b)(5) to apply first to reduce the basis (under section 1017) of

depreciable property

5

6

Applied to reduce any net operating loss that occurred in the tax year of the discharge or carried over to the

tax year of the discharge

6

7

Applied to reduce any general business credit carryover to or from the tax year of the discharge

7

8

Applied to reduce any minimum tax credit as of the beginning of the tax year immediately after the tax year

of the discharge

8

9

Applied to reduce any net capital loss for the tax year of the discharge, including any capital loss carryovers

to the tax year of the discharge

9

10 a Applied to reduce the basis of nondepreciable and depreciable property if not reduced on line 5. DO NOT

use in the case of discharge of qualified farm indebtedness

10 a

b Applied to reduce the basis of your principal residence. Enter amount here ONLY if line 1e is checked

10 b

11 For a discharge of qualified farm indebtedness applied to reduce the basis of:

a Depreciable property used or held for use in a trade or business or for the production of income if not

reduced on line 5

11 a

b Land used or held for use in a trade or business of farming

11 b

c Other property used or held for use in a trade or business or for the production of income

11 c

12 Applied to reduce any passive activity loss and credit carryovers from the tax year of the discharge

12

13 Applied to reduce any foreign tax credit carryover to or from the tax year of the discharge

13

Part III

Consent of Corporation to Adjustment of Basis of Its Property Under Section 1082(a)(2)

$

Under section 1081(b), the corporation named above has excluded

from its gross income

for the tax year beginning

and ending

.

Under that section, the corporation consents to have the basis of its property adjusted in accordance with the regulations prescribed

under section 1082(a)(2) in effect at the time of filing its income tax return for that year. The corporation is organized under the

laws of

.

(State of incorporation)

Note: You must attach a description of the transactions resulting in the nonrecognition of gain under section 1081.

BAA For Paperwork Reduction Act Notice, see instructions

Form 982 (Rev 2-2011)

FDIA3401

02/21/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1