A

D

R

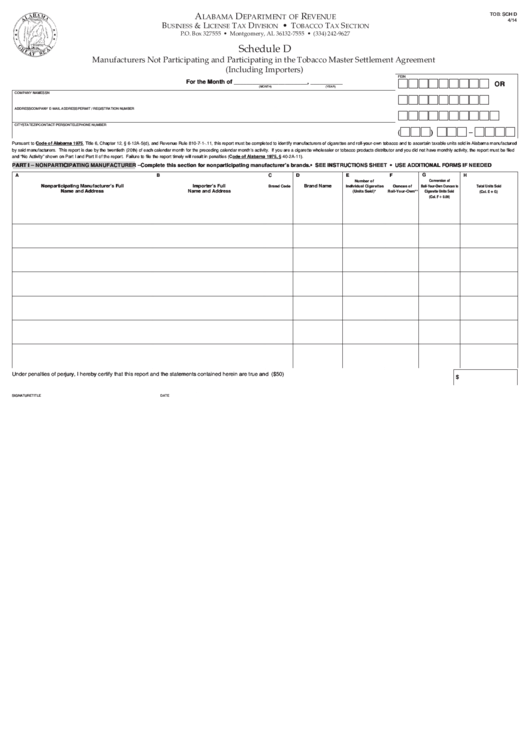

TOB: SCH D

LABAMA

EPARTMENT OF

EVENUE

4/14

B

& L

T

D

• T

T

S

USINESS

ICENSE

AX

IVISION

OBACCO

AX

ECTION

Reset

P.O. Box 327555 • Montgomery, AL 36132-7555 • (334) 242-9627

Schedule D

Manufacturers Not Participating and Participating in the Tobacco Master Settlement Agreement

(Including Importers)

FEIN

For the Month of _______________________, __________

OR

(MONTH)

(YEAR)

COMPANY NAME

SSN

ADDRESS

COMPANY E-MAIL ADDRESS

PERMIT / REGISTRATION NUMBER

CITY

STATE

ZIP

CONTACT PERSON

TELEPHONE NUMBER

(

)

–

Pursuant to Code of Alabama 1975, Title 6, Chapter 12, § 6-12A-5(d), and Revenue Rule 810-7-1-.11, this report must be completed to identify manufacturers of cigarettes and roll-your-own tobacco and to ascertain taxable units sold in Alabama manufactured

by said manufacturers. This report is due by the twentieth (20th) of each calendar month for the preceding calendar month’s activity. If you are a cigarette wholesaler or tobacco products distributor and you did not have monthly activity, the report must be filed

and “No Activity” shown on Part I and Part II of the report. Failure to file the report timely will result in penalties (Code of Alabama 1975, § 40-2A-11).

PART I – NONPARTICIPATING MANUFACTURER – Complete this section for nonparticipating manufacturer’s brands.

• SEE INSTRUCTIONS SHEET • USE ADDITIONAL FORMS IF NEEDED

A

B

C

D

E

F

G

H

Number of

Conversion of

Nonparticipating Manufacturer’s Full

Importer’s Full

Brand Code

Brand Name

Individual Cigarettes

Ounces of

Roll-Your-Own Ounces to

Total Units Sold

+

Cigarette Units Sold

Name and Address

Name and Address

(Units Sold)*

Roll-Your-Own**

(Col. E

G)

÷

(Col. F

0.09)

Under penalties of perjury, I hereby certify that this report and the statements contained herein are true and correct.

Failure To Timely File Return Penalty ($50)

$

SIGNATURE

TITLE

DATE

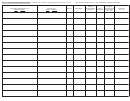

1

1 2

2 3

3 4

4