Form And Contents Of Resale Certificate

ADVERTISEMENT

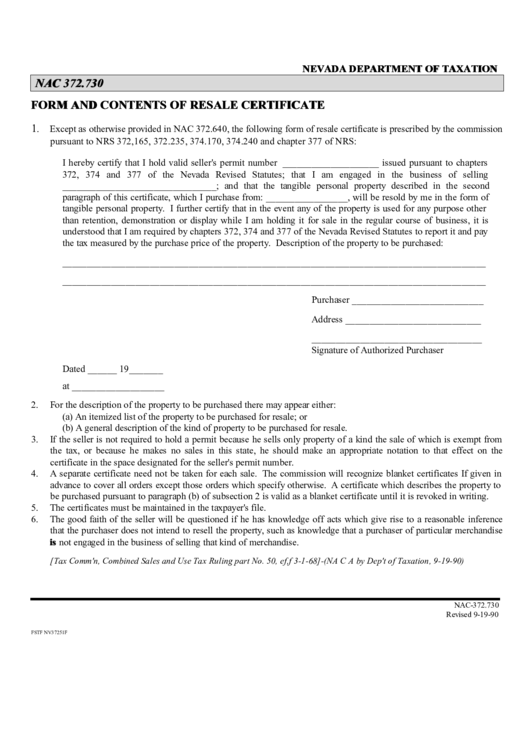

NEVADA DEPARTMENT OF TAXATION

NAC 372.730

FORM AND CONTENTS OF RESALE CERTIFICATE

1

.

Except as otherwise provided in NAC 372.640, the following form of resale certificate is prescribed by the commission

pursuant to NRS 372,165, 372.235, 374.170, 374.240 and chapter 377 of NRS:

I hereby certify that I hold valid seller's permit number ____________________ issued pursuant to chapters

372, 374 and 377 of the Nevada Revised Statutes; that I am engaged in the business of selling

________________________________; and that the tangible personal property described in the second

paragraph of this certificate, which I purchase from: _________________, will be resold by me in the form of

tangible personal property. I further certify that in the event any of the property is used for any purpose other

than retention, demonstration or display while I am holding it for sale in the regular course of business, it is

understood that I am required by chapters 372, 374 and 377 of the Nevada Revised Statutes to report it and pay

the tax measured by the purchase price of the property. Description of the property to be purchased:

_______________________________________________________________________________________

_______________________________________________________________________________________

Purchaser ___________________________

Address ____________________________

___________________________________

Signature of Authorized Purchaser

Dated ______ 19_______

at ___________________

2.

For the description of the property to be purchased there may appear either:

(a) An itemized list of the property to be purchased for resale; or

(b) A general description of the kind of property to be purchased for resale.

3.

If the seller is not required to hold a permit because he sells only property of a kind the sale of which is exempt from

the tax, or because he makes no sales in this state, he should make an appropriate notation to that effect on the

certificate in the space designated for the seller's permit number.

4.

A separate certificate need not be taken for each sale. The commission will recognize blanket certificates If given in

advance to cover all orders except those orders which specify otherwise. A certificate which describes the property to

be purchased pursuant to paragraph (b) of subsection 2 is valid as a blanket certificate until it is revoked in writing.

5.

The certificates must be maintained in the taxpayer's file.

6.

The good faith of the seller will be questioned if he has knowledge off acts which give rise to a reasonable inference

that the purchaser does not intend to resell the property, such as knowledge that a purchaser of particular merchandise

is not engaged in the business of selling that kind of merchandise.

[Tax Comm'n, Combined Sales and Use Tax Ruling part No. 50, ef,f 3-1-68]-(NA C A by Dep't of Taxation, 9-19-90)

NAC-372.730

Revised 9-19-90

FSTF NV37251F

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1