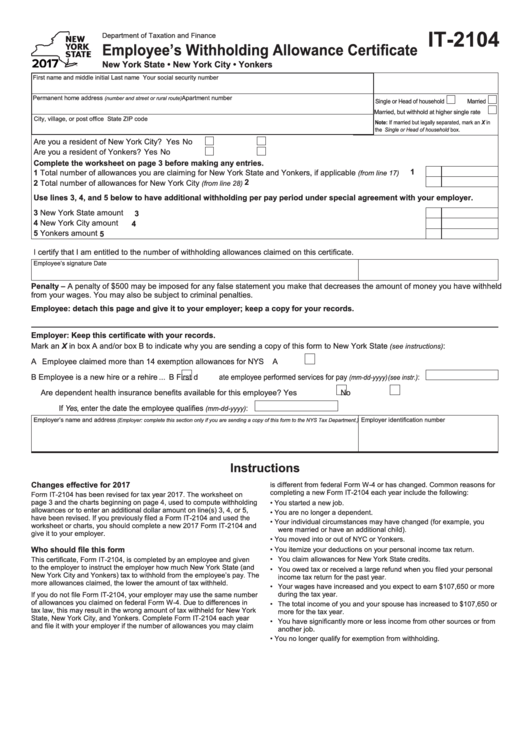

IT-2104

Department of Taxation and Finance

Employee’s Withholding Allowance Certificate

New York State • New York City • Yonkers

First name and middle initial

Last name

Your social security number

Permanent home address

Apartment number

(number and street or rural route)

Single or Head of household

Married

Married, but withhold at higher single rate

City, village, or post office

State

ZIP code

Note: If married but legally separated, mark an X in

the Single or Head of household box.

Are you a resident of New York City? ........... Yes

No

Are you a resident of Yonkers? ..................... Yes

No

Complete the worksheet on page 3 before making any entries.

1

1 Total number of allowances you are claiming for New York State and Yonkers, if applicable

...........

(from line 17)

2

2 Total number of allowances for New York City

..................................................................................

(from line 28)

Use lines 3, 4, and 5 below to have additional withholding per pay period under special agreement with your employer.

3 New York State amount ........................................................................................................................................

3

4 New York City amount ...........................................................................................................................................

4

5 Yonkers amount ....................................................................................................................................................

5

I certify that I am entitled to the number of withholding allowances claimed on this certificate.

Employee’s signature

Date

Penalty – A penalty of $500 may be imposed for any false statement you make that decreases the amount of money you have withheld

from your wages. You may also be subject to criminal penalties.

Employee: detach this page and give it to your employer; keep a copy for your records.

Employer: Keep this certificate with your records.

Mark an X in box A and/or box B to indicate why you are sending a copy of this form to New York State

:

(see instructions)

A Employee claimed more than 14 exemption allowances for NYS ............ A

B Employee is a new hire or a rehire ... B

First date employee performed services for pay

:

(mm-dd-yyyy) (see instr.)

Are dependent health insurance benefits available for this employee? ............. Yes

No

If Yes, enter the date the employee qualifies

:

(mm-dd-yyyy)

Employer’s name and address

Employer identification number

(Employer: complete this section only if you are sending a copy of this form to the NYS Tax Department.)

Instructions

Changes effective for 2017

is different from federal Form W-4 or has changed. Common reasons for

completing a new Form IT-2104 each year include the following:

Form IT-2104 has been revised for tax year 2017. The worksheet on

page 3 and the charts beginning on page 4, used to compute withholding

• You started a new job.

allowances or to enter an additional dollar amount on line(s) 3, 4, or 5,

• You are no longer a dependent.

have been revised. If you previously filed a Form IT-2104 and used the

• Your individual circumstances may have changed (for example, you

worksheet or charts, you should complete a new 2017 Form IT-2104 and

were married or have an additional child).

give it to your employer.

• You moved into or out of NYC or Yonkers.

Who should file this form

• You itemize your deductions on your personal income tax return.

• You claim allowances for New York State credits.

This certificate, Form IT-2104, is completed by an employee and given

to the employer to instruct the employer how much New York State (and

• You owed tax or received a large refund when you filed your personal

New York City and Yonkers) tax to withhold from the employee’s pay. The

income tax return for the past year.

more allowances claimed, the lower the amount of tax withheld.

• Your wages have increased and you expect to earn $107,650 or more

during the tax year.

If you do not file Form IT-2104, your employer may use the same number

of allowances you claimed on federal Form W-4. Due to differences in

• The total income of you and your spouse has increased to $107,650 or

tax law, this may result in the wrong amount of tax withheld for New York

more for the tax year.

State, New York City, and Yonkers. Complete Form IT-2104 each year

• You have significantly more or less income from other sources or from

and file it with your employer if the number of allowances you may claim

another job.

• You no longer qualify for exemption from withholding.

1

1 2

2 3

3 4

4 5

5 6

6 7

7