Hardship Letter Template

ADVERTISEMENT

Hardship Lip Letter

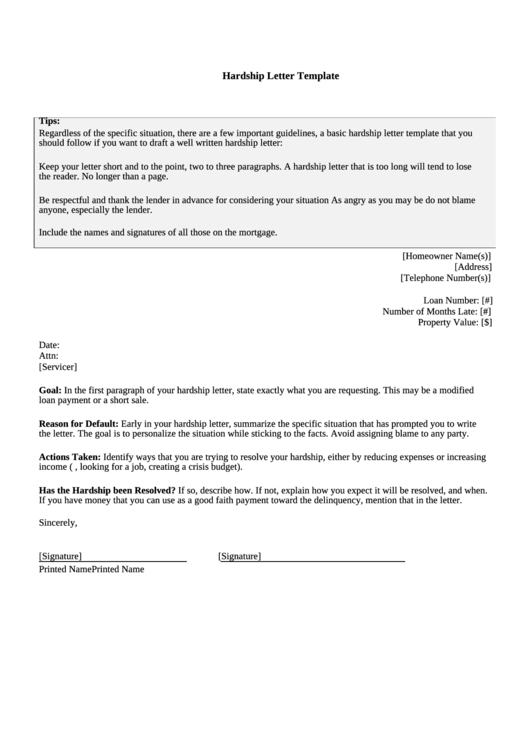

Hardship Letter Template

Tips:

Regardless of the specific situation, there are a few important guidelines, a basic hardship letter template that you

should follow if you want to draft a well written hardship letter:

Keep your letter short and to the point, two to three paragraphs. A hardship letter that is too long will tend to lose

the reader. No longer than a page.

Be respectful and thank the lender in advance for considering your situation As angry as you may be do not blame

anyone, especially the lender.

Include the names and signatures of all those on the mortgage.

[Homeowner Name(s)]

[Address]

[Telephone Number(s)]

Loan Number: [#]

Number of Months Late: [#]

Property Value: [$]

Date:

Attn:

[Servicer]

Goal: In the first paragraph of your hardship letter, state exactly what you are requesting. This may be a modified

loan payment or a short sale.

Reason for Default: Early in your hardship letter, summarize the specific situation that has prompted you to write

the letter. The goal is to personalize the situation while sticking to the facts. Avoid assigning blame to any party.

Actions Taken: Identify ways that you are trying to resolve your hardship, either by reducing expenses or increasing

income (e.g. renting a room, looking for a job, creating a crisis budget).

Has the Hardship been Resolved? If so, describe how. If not, explain how you expect it will be resolved, and when.

If you have money that you can use as a good faith payment toward the delinquency, mention that in the letter.

Sincerely,

[Signature]

[Signature]

Printed Name

Printed Name

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Letters

1

1 2

2