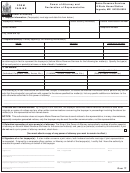

If the power of attorney is granted to a person other than an attorney, certifi ed public accountant or enrolled agent, the

taxpayer(s) signature must be witnessed or notarized below. (The representative(s) must complete Part II.)

The person(s) signing as or for the taxpayer(s): (Check and complete one.)

is/are known to, and signed in the presence of, the two disinterested witnesses whose signatures

appear here:

___________________________________________

_______________________________

(Signature of Witness)

(Date)

___________________________________________

_______________________________

(Signature of Witness)

(Date)

appeared this day before a notary public and acknowledged this power of attorney as a voluntary

act and deed.

Witness: ________________________________

________________

NOTARIAL SEAL

(Signature of Notary)

(Date)

PART II

My commission expires: _____________

PART II

Declaration of Representative

Under penalties of perjury, I declare that I am: (Circle one)

1. A member in good standing of the bar of the highest court of the jurisdiction shown below;

2. Duly qualifi ed to practice as a certifi ed public accountant in the jurisdiction shown below;

3. An enrolled agent enrolled under U. S. Department of Treasury Circular 230;

4. A bona fi de offi cer of the taxpayer’s organization;

5. A full-time employee of the taxpayer;

6. A member of the taxpayer’s immediate family (spouse, parent, child, brother or sister);

7. A fi duciary for the taxpayer;

8. Other (Explain) ______________________________________________________________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

Designation

Jurisdiction

Signature

Date

(insert appropriate

(state, etc.)

number from list above)

IF THIS DECLARATION OF REPRESENTATIVE IS NOT SIGNED AND DATED,

THE POWER OF ATTORNEY WILL BE RETURNED.

Revised: April, 2008

1

1 2

2