Sample Consumer Denial Letter Template

ADVERTISEMENT

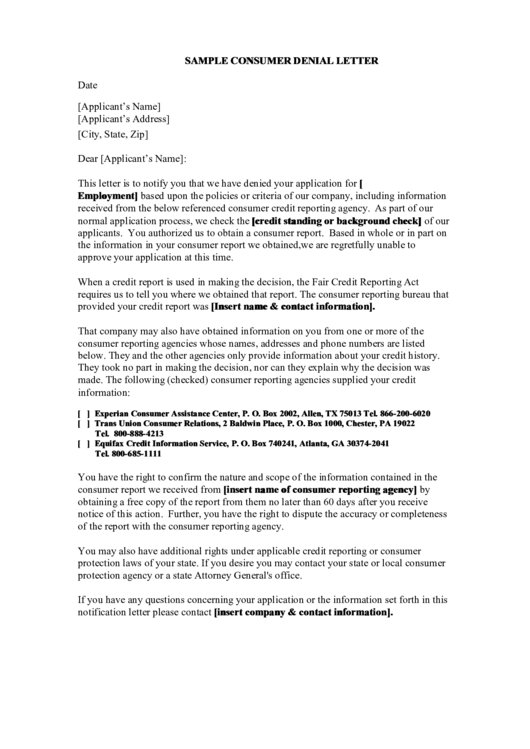

SAMPLE CONSUMER DENIAL LETTER

Date

[Applicant’s Name]

[Applicant’s Address]

[City, State, Zip]

Dear [Applicant’s Name]:

This letter is to notify you that we have denied your application for [e.g. Credit or

Employment] based upon the policies or criteria of our company, including information

received from the below referenced consumer credit reporting agency. As part of our

normal application process, we check the [credit standing or background check] of our

applicants. You authorized us to obtain a consumer report. Based in whole or in part on

the information in your consumer report we obtained, we are regretfully unable to

approve your application at this time.

When a credit report is used in making the decision, the Fair Credit Reporting Act

requires us to tell you where we obtained that report. The consumer reporting bureau that

provided your credit report was [Insert name & contact information].

That company may also have obtained information on you from one or more of the

consumer reporting agencies whose names, addresses and phone numbers are listed

below. They and the other agencies only provide information about your credit history.

They took no part in making the decision, nor can they explain why the decision was

made. The following (checked) consumer reporting agencies supplied your credit

information:

[ ] Experian Consumer Assistance Center, P. O. Box 2002, Allen, TX 75013 Tel. 866-200-6020

[ ] Trans Union Consumer Relations, 2 Baldwin Place, P. O. Box 1000, Chester, PA 19022

Tel. 800-888-4213

[ ] Equifax Credit Information Service, P. O. Box 740241, Atlanta, GA 30374-2041

Tel. 800-685-1111

You have the right to confirm the nature and scope of the information contained in the

consumer report we received from [insert name of consumer reporting agency] by

obtaining a free copy of the report from them no later than 60 days after you receive

notice of this action. Further, you have the right to dispute the accuracy or completeness

of the report with the consumer reporting agency.

You may also have additional rights under applicable credit reporting or consumer

protection laws of your state. If you desire you may contact your state or local consumer

protection agency or a state Attorney General's office.

If you have any questions concerning your application or the information set forth in this

notification letter please contact [insert company & contact information].

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Letters

1

1 2

2