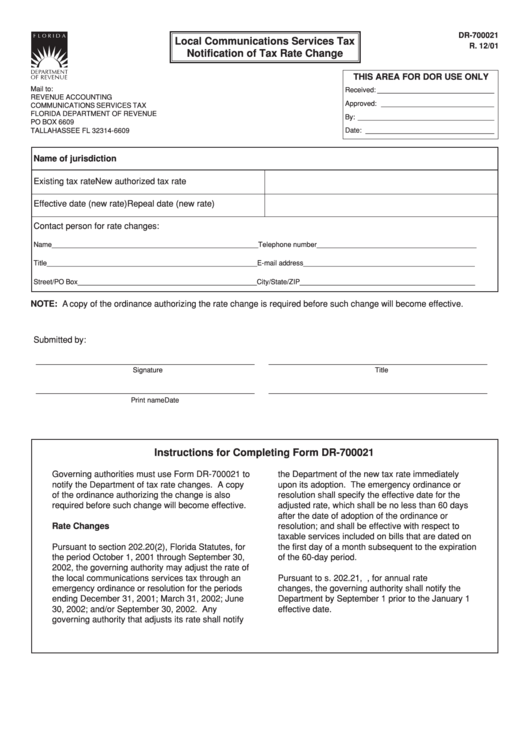

Local Communications Services Tax Notification Of Tax Rate Change

ADVERTISEMENT

DR-700021

Local Communications Services Tax

R. 12/01

Notification of Tax Rate Change

THIS AREA FOR DOR USE ONLY

Mail to:

Received: ______________________________

REVENUE ACCOUNTING

Approved: _____________________________

COMMUNICATIONS SERVICES TAX

FLORIDA DEPARTMENT OF REVENUE

By: ___________________________________

PO BOX 6609

TALLAHASSEE FL 32314-6609

Date: _________________________________

Name of jurisdiction

Existing tax rate

New authorized tax rate

Effective date (new rate)

Repeal date (new rate)

Contact person for rate changes:

Name _____________________________________________________

Telephone number _________________________________________

Title ______________________________________________________

E-mail address ____________________________________________

Street/PO Box ______________________________________________

City/State/ZIP _____________________________________________

NOTE: A copy of the ordinance authorizing the rate change is required before such change will become effective.

Submitted by:

______________________________________________

______________________________________________

Signature

Title

______________________________________________

______________________________________________

Print name

Date

Instructions for Completing Form DR-700021

Governing authorities must use Form DR-700021 to

the Department of the new tax rate immediately

notify the Department of tax rate changes. A copy

upon its adoption. The emergency ordinance or

of the ordinance authorizing the change is also

resolution shall specify the effective date for the

required before such change will become effective.

adjusted rate, which shall be no less than 60 days

after the date of adoption of the ordinance or

Rate Changes

resolution; and shall be effective with respect to

taxable services included on bills that are dated on

Pursuant to section 202.20(2), Florida Statutes, for

the first day of a month subsequent to the expiration

the period October 1, 2001 through September 30,

of the 60-day period.

2002, the governing authority may adjust the rate of

the local communications services tax through an

Pursuant to s. 202.21, F.S., for annual rate

emergency ordinance or resolution for the periods

changes, the governing authority shall notify the

ending December 31, 2001; March 31, 2002; June

Department by September 1 prior to the January 1

30, 2002; and/or September 30, 2002. Any

effective date.

governing authority that adjusts its rate shall notify

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1