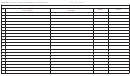

Form S-3a - Agricultural Fertilizers, Pesticides, Machinery & Equipment Page 2

ADVERTISEMENT

INSTRUCTIONS FOR USE OF AGRICULTURAL EXEMPTION CERTIFICATE (Form S-3A)

1. This certificate is used to document exemption from Vermont sales tax provided by Title 32, Vermont Statutes

Annotated, §9741(25) for agricultural machinery and equipment for use and consumption directly and exclu-

sively, except for isolated or occasional uses, in the production for sale of tangible personal property on farms,

orchards, nurseries, or in greenhouses or other similar structures used primarily for the raising of agricultural

or horticultural commodities for sale. Beginning July 1, 2002, it is also used to document sales of fertilizers

and pesticides for those uses.

2. Tax applies to sales of these items unless the seller has accepted, in good faith, a properly completed exemp-

tion certificate from the buyer. A seller who has not charged tax in reliance with an exemption certificate

accepted in good faith will not be liable for the tax. If the exemption claim proves to be incorrect, the Depart-

ment will seek the tax from the buyer, but not the seller.

3. GOOD FAITH

A certificate has been taken in good faith if:

(a) It contains no statement or entry which the seller knows, or has reason to know, is false or

misleading.

(b) The certification is on Form S-3A or a form with substantially identical language.

(c) The certificate is dated and complete.

(d) The property purchased is of a type ordinarily used for the stated purpose or the exempt use is

explained.

(e) The certificate has been received prior to or at the time of the sale.

4. THE AGRICULTURAL EXEMPTION {32 V.S.A. §§ 9741(3), 9741(25)}

Certain agricultural supplies (listed on the front of this form) are always exempt and no exemption certificate

is required. These items are exempt regardless of whether the buyer intends to use them in agricultural produc-

tion. Agricultural machinery or equipment, fertilizers and pesticides are exempt only when sold for use in

agricultural production for sale and Form S-3A is completed. Supplies (other than those listed as always

exempt), other equipment, building materials and tools are taxable, even if used on a farm.

5. ELECTRICITY, OIL, GAS, AND OTHER FUELS. Electricity and fuel used directly and exclusively for

farm purposes is not taxable. In most cases no exemption certificate is required. Some suppliers may require

that Form S-3F is completed if the use is not obvious or if only a portion of the fuel purchased is exempt.

6. FARMS. Farms include enterprises using land and improvements for agricultural production for sale. Agri-

cultural production includes crops such as fruits, vegetables, turf and sod crops, livestock, bees and apiary

products, Christmas trees, and maple syrup.

7. ADDITIONAL PURCHASES BY SAME BUYER If the buyer has this as a Multiple Purchase certificate, the

certificate covers additional purchases of the same type of property. For each subsequent purchase, the seller

must show sufficient identifying information on the sales slip to trace the purchase to the exemption certificate

on file.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2