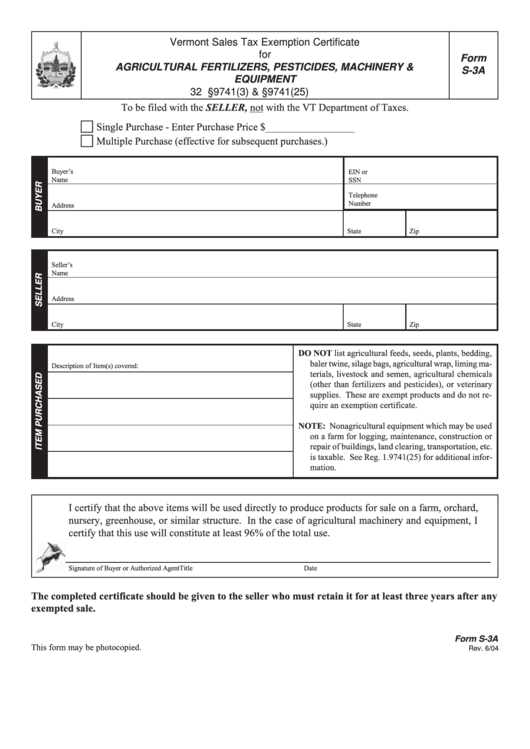

Form S-3a - Agricultural Fertilizers, Pesticides, Machinery & Equipment

ADVERTISEMENT

Vermont Sales Tax Exemption Certificate

for

Form

AGRICULTURAL FERTILIZERS, PESTICIDES, MACHINERY &

S-3A

EQUIPMENT

32 V.S.A. §9741(3) & §9741(25)

To be filed with the SELLER, not with the VT Department of Taxes.

Single Purchase - Enter Purchase Price $ _________________

Multiple Purchase (effective for subsequent purchases.)

Buyer’s

EIN or

Name

SSN

Telephone

Number

Address

City

State

Zip

Seller’s

Name

Address

City

State

Zip

DO NOT list agricultural feeds, seeds, plants, bedding,

baler twine, silage bags, agricultural wrap, liming ma-

Description of Item(s) covered:

terials, livestock and semen, agricultural chemicals

(other than fertilizers and pesticides), or veterinary

supplies. These are exempt products and do not re-

quire an exemption certificate.

NOTE: Nonagricultural equipment which may be used

on a farm for logging, maintenance, construction or

repair of buildings, land clearing, transportation, etc.

is taxable. See Reg. 1.9741(25) for additional infor-

mation.

I certify that the above items will be used directly to produce products for sale on a farm, orchard,

nursery, greenhouse, or similar structure. In the case of agricultural machinery and equipment, I

certify that this use will constitute at least 96% of the total use.

Signature of Buyer or Authorized Agent

Title

Date

The completed certificate should be given to the seller who must retain it for at least three years after any

exempted sale.

Form S-3A

This form may be photocopied.

Rev. 6/04

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2