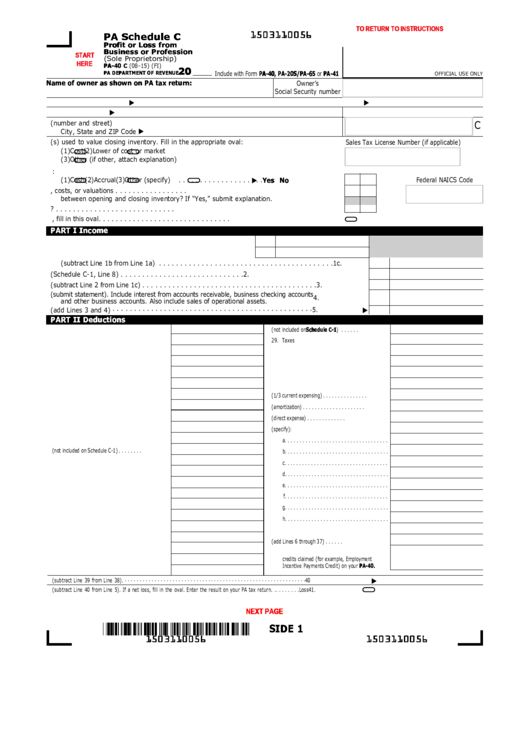

TO RETURN TO INSTRUCTIONS CLICK HERE

1503110056

PA Schedule C

Profit or Loss from

Business or Profession

START

(Sole Proprietorship)

HERE

20

PA-40 C (08-15) (FI)

PA DEPARTMENT OF REVENUE

Include with Form PA-40, PA-20S/PA-65 or PA-41

OFFICIAL USE ONLY

Name of owner as shown on PA tax return:

Owner’s

Social Security number

A. Main business activity

Product or service

C. Federal Employer Identification Number

B. Business name

D. Business address (number and street)

C

City, State and ZIP Code

E. Method(s) used to value closing inventory. Fill in the appropriate oval:

Sales Tax License Number (if applicable)

(1)

Cost

(2)

Lower of cost or market

(3)

Other (if other, attach explanation)

F. Accounting method. Fill in the appropriate oval:

(1)

Cash

(2)

Accrual

(3)

Other (specify)

. . . . . . . . . . . . . . . . . . . . Yes No

Federal NAICS Code

G. Was there any change in determining quantities, costs, or valuations . . . . . . . . . . . . . . . . .

between opening and closing inventory? If “Yes,” submit explanation.

H. Did you deduct expenses for an office in your home? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I. If the business is out of existence, fill in this oval. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART I Income

1. a. Gross receipts or sales . . . . . . . . . . . . . . . . . . . . . . . . . . 1a.

b. Returns and allowances . . . . . . . . . . . . . . . . . . . . . . . . . . 1b.

c. Balance (subtract Line 1b from Line 1a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1c.

2. Cost of goods sold and/or operations (Schedule C-1, Line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Gross profit (subtract Line 2 from Line 1c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. Other Income (submit statement). Include interest from accounts receivable, business checking accounts

4.

and other business accounts. Also include sales of operational assets.

5. Total income (add Lines 3 and 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

PART II Deductions

6. Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28. Supplies (not included on Schedule C-1) . . . . . .

29. Taxes

7. Amortization . . . . . . . . . . . . . . . . . . . . . . . . . . .

30. Telephone . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Bad debts from sales or services . . . . . . . . . . . .

9. Bank charges . . . . . . . . . . . . . . . . . . . . . . . . . .

31. Travel and entertainment . . . . . . . . . . . . . . . . . .

10. Car and truck expenses . . . . . . . . . . . . . . . . . . .

32. Utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Commissions . . . . . . . . . . . . . . . . . . . . . . . . . .

33. Wages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Cost depletion but not percentage depletion . . . .

34. IDCs (1/3 current expensing) . . . . . . . . . . . . . . .

13. a.

Regular depreciation . . . . . . . . . . . . . . . . .

35. IDCs (amortization) . . . . . . . . . . . . . . . . . . . . .

13. b.

Section 179 expense . . . . . . . . . . . . . . . .

36. Start-up costs (direct expense) . . . . . . . . . . . . .

14. Dues and publications . . . . . . . . . . . . . . . . . . . .

37. Other expenses (specify):

15. Employee benefit programs other than on Line 23

a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16. Freight (not included on Schedule C-1) . . . . . . . .

b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17. Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18. Interest on business indebtedness . . . . . . . . . . .

d. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19. Laundry and cleaning . . . . . . . . . . . . . . . . . . . .

e. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20. Legal and professional services . . . . . . . . . . . . .

f. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21. Management fees . . . . . . . . . . . . . . . . . . . . . . .

g. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22. Office supplies . . . . . . . . . . . . . . . . . . . . . . . . .

h. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23. Pension and profit-sharing plans for employees . .

37. Total other expenses . . . . . . . . . . . . . . . . . . . . .

24. Postage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

38. Total expenses. (add Lines 6 through 37) . . . . . .

25. Rent on business property . . . . . . . . . . . . . . . . .

39. Reduce expenses by the total business

credits claimed (for example, Employment

26. Repairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Incentive Payments Credit) on your PA-40.

27. Subcontractor fees . . . . . . . . . . . . . . . . . . . . . .

40. Total adjusted expenses (subtract Line 39 from Line 38). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

40

41. Net profit or loss (subtract Line 40 from Line 5). If a net loss, fill in the oval. Enter the result on your PA tax return. . . . . . . . . .Loss

41.

Reset Entire Form

NEXT PAGE

PRINT FORM

SIDE 1

1503110056

1503110056

1

1 2

2 3

3 4

4 5

5 6

6