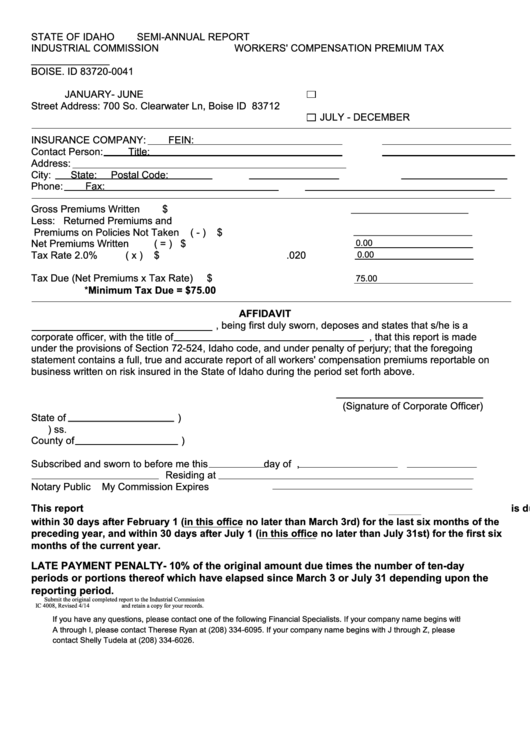

STATE OF IDAHO

SEMI-ANNUAL REPORT

INDUSTRIAL COMMISSION

WORKERS' COMPENSATION PREMIUM TAX

P.O. BOX 83720

FOR THE PERIOD AND YEAR ______________

BOISE. ID 83720-0041

JANUARY- JUNE

Street Address: 700 So. Clearwater Ln, Boise ID 83712

JULY - DECEMBER

INSURANCE COMPANY:

FEIN:

Contact Person:

Title:

Address:

City:

State:

Postal Code:

Phone:

Fax:

Gross Premiums Written

$

Less: Returned Premiums and

Premiums on Policies Not Taken

( - )

$

Net Premiums Written

( = ) $

0.00

Tax Rate 2.0%

( x )

$

0.00

.020

Tax Due (Net Premiums x Tax Rate)

$

75.00

*Minimum Tax Due = $75.00

AFFIDAVIT

, being first duly sworn, deposes and states that s/he is a

corporate officer, with the title of

, that this report is made

under the provisions of Section 72-524, Idaho code, and under penalty of perjury; that the foregoing

statement contains a full, true and accurate report of all workers' compensation premiums reportable on

business written on risk insured in the State of Idaho during the period set forth above.

(Signature of Corporate Officer)

State of

)

) ss.

County of

)

Subscribed and sworn to before me this

day of

,

Residing at

Notary Public

My Commission Expires

This report

is due

within 30 days after February 1 (in this office no later than March 3rd) for the last six months of the

preceding year, and within 30 days after July 1 (in this office no later than July 31st) for the first six

months of the current year.

LATE PAYMENT PENALTY- 10% of the original amount due times the number of ten-day

periods or portions thereof which have elapsed since March 3 or July 31 depending upon the

reporting period.

Submit the original completed report to the Industrial Commission

IC 4008, Revised 4/ 14

and retain a copy for your records.

If you have any questions, please contact one of the following Financial Specialists. If your company name begins with

A through I, please contact Therese Ryan at (208) 334-6095. If your company name begins with J through Z, please

contact Shelly Tudela at (208) 334-6026.

1

1