Clear Form

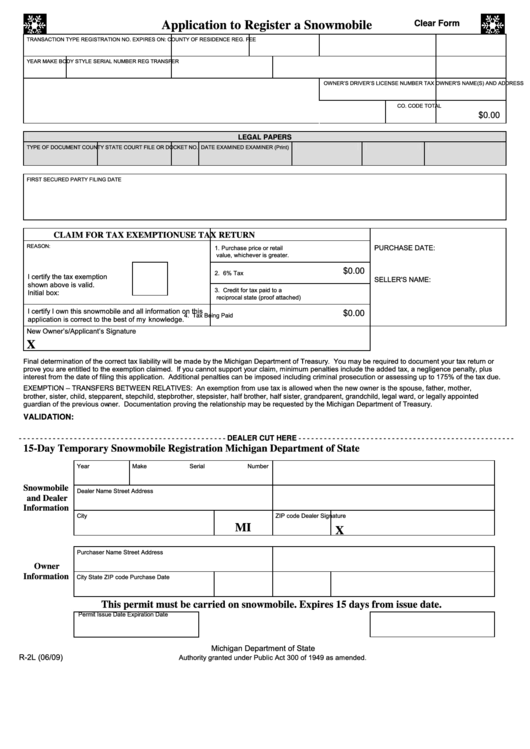

Application to Register a Snowmobile

TRANSACTION TYPE

REGISTRATION NO.

EXPIRES ON:

COUNTY OF RESIDENCE

REG. FEE

YEAR

MAKE

BODY STYLE

SERIAL NUMBER

REG TRANSFER

OWNER'S NAME(S) AND ADDRESS

OWNER’S DRIVER’S LICENSE NUMBER

TAX

CO. CODE

TOTAL

$0.00

LEGAL PAPERS

TYPE OF DOCUMENT

COUNTY

STATE

COURT

FILE OR DOCKET NO.

DATE EXAMINED

EXAMINER (Print)

FIRST SECURED PARTY

FILING DATE

CLAIM FOR TAX EXEMPTION

USE TAX RETURN

REASON:

PURCHASE DATE:

1. Purchase price or retail

value, whichever is greater.

$0.00

2. 6% Tax

I certify the tax exemption

SELLER'S NAME:

shown above is valid.

3. Credit for tax paid to a

Initial box:

reciprocal state (proof attached)

I certify I own this snowmobile and all information on this

$0.00

4. Tax Being Paid

application is correct to the best of my knowledge.

New Owner’s/Applicant’s Signature

X

Final determination of the correct tax liability will be made by the Michigan Department of Treasury. You may be required to document your tax return or

prove you are entitled to the exemption claimed. If you cannot support your claim, minimum penalties include the added tax, a negligence penalty, plus

interest from the date of filing this application. Additional penalties can be imposed including criminal prosecution or assessing up to 175% of the tax due.

EXEMPTION ─ TRANSFERS BETWEEN RELATIVES: An exemption from use tax is allowed when the new owner is the spouse, father, mother,

brother, sister, child, stepparent, stepchild, stepbrother, stepsister, half brother, half sister, grandparent, grandchild, legal ward, or legally appointed

guardian of the previous ow

ner. Documentation proving the relationship may be requested by the Michigan Department of Treasury.

VALIDATION:

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

DEALER CUT HERE

15-Day Temporary Snowmobile Registration

Michigan Department of State

Year

Make

Serial Number

Snowmobile

Dealer Name

Street Address

and Dealer

Information

City

ZIP code

Dealer Signature

MI

X

Purchaser Name

Street Address

Owner

Information

City

State

ZIP code

Purchase Date

This permit must be carried on snowmobile.

Expires 15 days from issue date.

Permit Issue Date

Expiration Date

Michigan Department of State

R-2L (06/09)

Authority granted under Public Act 300 of 1949 as amended.

1

1