Service Purchase Application Form

Download a blank fillable Service Purchase Application Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Service Purchase Application Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

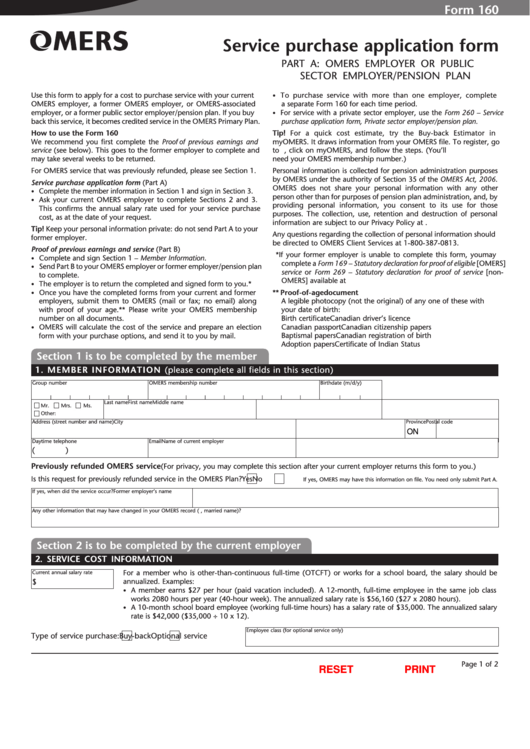

Form 160

Service purchase application form

PA R T A : O M E R S E M P L O Y E R O R P U B L I C

S E C T O R E M P L O Y E R / P E N S I O N P L A N

Use this form to apply for a cost to purchase service with your current

To purchase service with more than one employer, complete

•

OMERS employer, a former OMERS employer, or OMERS-associated

a separate Form 160 for each time period.

employer, or a former public sector employer/pension plan. If you buy

For service with a private sector employer, use the Form 260 – Service

•

back this service, it becomes credited service in the OMERS Primary Plan.

purchase application form, Private sector employer/pension plan.

How to use the Form 160

Tip! For a quick cost estimate, try the Buy-back Estimator in

We recommend you first complete the Proof of previous earnings and

myOMERS. It draws information from your OMERS file. To register, go

service (see below). This goes to the former employer to complete and

to , click on myOMERS, and follow the steps. (You’ll

may take several weeks to be returned.

need your OMERS membership number.)

For OMERS service that was previously refunded, please see Section 1.

Personal information is collected for pension administration purposes

by OMERS under the authority of Section 35 of the OMERS ct, 2006.

Service purchase application form (Part A)

OMERS does not share your personal information with any other

Complete the member information in Section 1 and sign in Section 3.

•

person other than for purposes of pension plan administration, and, by

Ask your current OMERS employer to complete Sections 2 and 3.

•

providing personal information, you consent to its use for those

This confirms the annual salary rate used for your service purchase

purposes. The collection, use, retention and destruction of personal

cost, as at the date of your request.

information are subject to our Privacy Policy at .

Tip! Keep your personal information private: do not send Part A to your

Any questions regarding the collection of personal information should

former employer.

be directed to OMERS Client Services at 1-800-387-0813.

roof of previous earnings and service (Part B)

** If your former employer is unable to complete this form, you may

Complete and sign Section 1 – Member Information.

•

complete a Form 169 – Statutory declaration for proof of eligible [OMERS]

Send Part B to your OMERS employer or former employer/pension plan

•

service or Form 269 – Statutory declaration for proof of service [non-

to complete.

OMERS] available at .

The employer is to return the completed and signed form to you.*

•

** Proof-of-age document

Once you have the completed forms from your current and former

•

employers, submit them to OMERS (mail or fax; no email) along

A legible photocopy (not the original) of any one of these with

your date of birth:

with proof of your age.** Please write your OMERS membership

number on all documents.

Birth certificate

Canadian driver’s licence

OMERS will calculate the cost of the service and prepare an election

Canadian passport

Canadian citizenship papers

•

form with your purchase options, and send it to you by mail.

Baptismal papers

Canadian registration of birth

Adoption papers

Certificate of Indian Status

Section 1 is to be completed by the member

1. MEMBER INFORMATION (please complete all fields in this section)

Group number

OMERS membership number

Birthdate (m/d/y)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last name

First name

Middle name

Mr.

Mrs.

Ms.

Other:

Address (street number and name)

City

Province

Postal code

ON

Daytime telephone

Email

Name of current employer

(

)

Previously refunded OMERS service

(For privacy, you may complete this section after your current employer returns this form to you.)

Is this request for previously refunded service in the OMERS Plan?

Yes

No

If yes, OMERS may have this information on file. You need only submit Part A.

If yes, when did the service occur?

Former employer’s name

Any other information that may have changed in your OMERS record (e.g., married name)?

Section 2 is to be completed by the current employer

2. SERVICE COST INFORMATION

Current annual salary rate

For a member who is other-than-continuous full-time (OTCFT) or works for a school board, the salary should be

$

annualized. Examples:

A member earns $27 per hour (paid vacation included). A 12-month, full-time employee in the same job class

•

works 2080 hours per year (40-hour week). The annualized salary rate is $56,160 ($27 x 2080 hours).

A 10-month school board employee (working full-time hours) has a salary rate of $35,000. The annualized salary

•

rate is $42,000 ($35,000 ÷ 10 x 12).

Employee class (for optional service only)

Type of service purchase:

Buy-back

Optional service

Page 1 of 2

RESET

PRINT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4