4

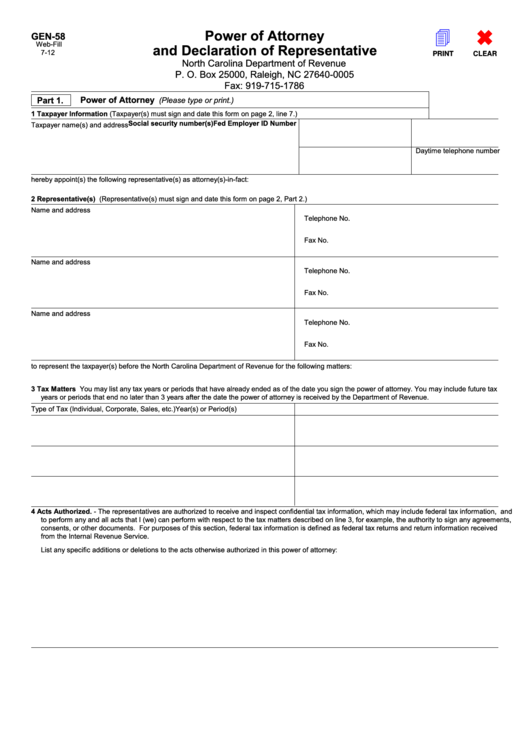

Power of Attorney

GEN-58

Web-Fill

and Declaration of Representative

7-12

PRINT

CLEAR

North Carolina Department of Revenue

P. O. Box 25000, Raleigh, NC 27640-0005

Fax: 919-715-1786

Part 1.

Power of Attorney

(Please type or print.)

1 Taxpayer Information (Taxpayer(s) must sign and date this form on page 2, line 7.)

Social security number(s)

Fed Employer ID Number

Taxpayer name(s) and address

Daytime telephone number

hereby appoint(s) the following representative(s) as attorney(s)-in-fact:

2 Representative(s) (Representative(s) must sign and date this form on page 2, Part 2.)

Name and address

Telephone No.

Fax No.

Name and address

Telephone No.

Fax No.

Name and address

Telephone No.

Fax No.

to represent the taxpayer(s) before the North Carolina Department of Revenue for the following matters:

3 Tax Matters You may list any tax years or periods that have already ended as of the date you sign the power of attorney. You may include future tax

years or periods that end no later than 3 years after the date the power of attorney is received by the Department of Revenue.

Type of Tax (Individual, Corporate, Sales, etc.)

Year(s) or Period(s)

4 Acts Authorized. - The representatives are authorized to receive and inspect confidential tax information, which may include federal tax information, and

to perform any and all acts that I (we) can perform with respect to the tax matters described on line 3, for example, the authority to sign any agreements,

consents, or other documents. For purposes of this section, federal tax information is defined as federal tax returns and return information received

from the Internal Revenue Service.

List any specific additions or deletions to the acts otherwise authorized in this power of attorney:

1

1 2

2