Form Nucs-4556 - Power Of Attorney - Department Of Employment, State Of Nevada

ADVERTISEMENT

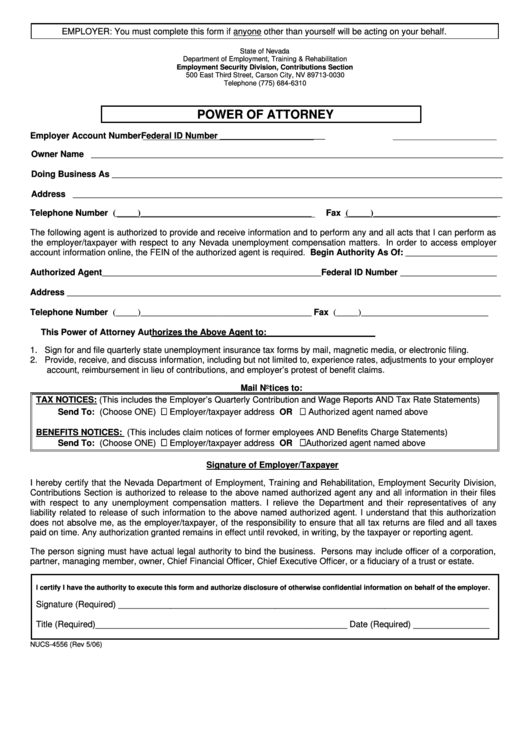

EMPLOYER: You must complete this form if anyone other than yourself will be acting on your behalf.

State of Nevada

Department of Employment, Training & Rehabilitation

Employment Security Division, Contributions Section

500 East Third Street, Carson City, NV 89713-0030

Telephone (775) 684-6310

POWER OF ATTORNEY

Employer Account Number

Federal ID Number ________________________

Owner Name ______________________________________________________________________________________________

Doing Business As _________________________________________________________________________________________

Address __________________________________________________________________________________________________

Telephone Number (_____)_______________________________________

Fax (_____)_____________________________

The following agent is authorized to provide and receive information and to perform any and all acts that I can perform as

the employer/taxpayer with respect to any Nevada unemployment compensation matters. In order to access employer

account information online, the FEIN of the authorized agent is required. Begin Authority As Of: _____________________

Authorized Agent__________________________________________________ Federal ID Number ______________________

Address ___________________________________________________________________________________________________

Telephone Number (_____)_______________________________________

Fax (_____)_____________________________

This Power of Attorney Authorizes the Above Agent to:

1. Sign for and file quarterly state unemployment insurance tax forms by mail, magnetic media, or electronic filing.

2. Provide, receive, and discuss information, including but not limited to, experience rates, adjustments to your employer

account, reimbursement in lieu of contributions, and employer’s protest of benefit claims.

Mail Notices to:

TAX NOTICES: (This includes the Employer’s Quarterly Contribution and Wage Reports AND Tax Rate Statements)

Send To: (Choose ONE)

Employer/taxpayer address OR

Authorized agent named above

BENEFITS NOTICES: (This includes claim notices of former employees AND Benefits Charge Statements)

Send To: (Choose ONE)

Employer/taxpayer address OR

Authorized agent named above

Signature of Employer/Taxpayer

I hereby certify that the Nevada Department of Employment, Training and Rehabilitation, Employment Security Division,

Contributions Section is authorized to release to the above named authorized agent any and all information in their files

with respect to any unemployment compensation matters. I relieve the Department and their representatives of any

liability related to release of such information to the above named authorized agent. I understand that this authorization

does not absolve me, as the employer/taxpayer, of the responsibility to ensure that all tax returns are filed and all taxes

paid on time. Any authorization granted remains in effect until revoked, in writing, by the taxpayer or reporting agent.

The person signing must have actual legal authority to bind the business. Persons may include officer of a corporation,

partner, managing member, owner, Chief Financial Officer, Chief Executive Officer, or a fiduciary of a trust or estate.

I certify I have the authority to execute this form and authorize disclosure of otherwise confidential information on behalf of the employer.

Signature (Required) ______________________________________________________________________________

Title (Required)_____________________________________________________ Date (Required) ________________

NUCS-4556 (Rev 5/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1