Form Ssa-L-93-Sm (04-11) - Retirement, Survivors And Disability Insurance Form

ADVERTISEMENT

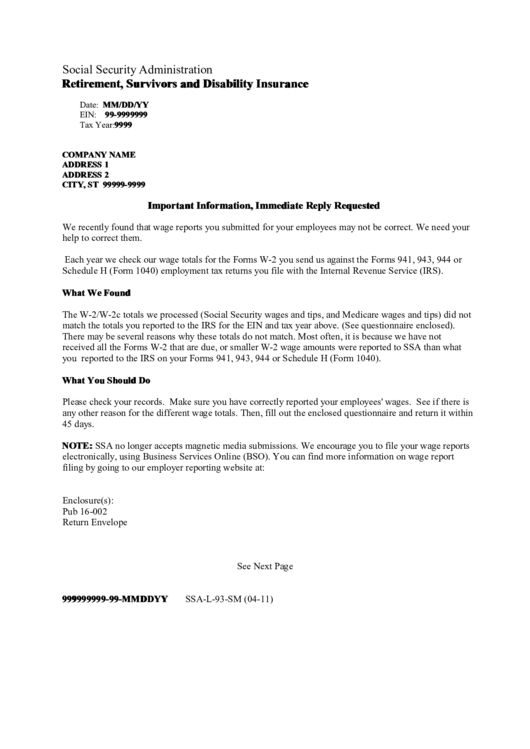

Social Security Administration

Retirement, Survivors and Disability Insurance

Date: MM/DD/YY

EIN: 99-9999999

Tax Year: 9999

COMPANY NAME

ADDRESS 1

ADDRESS 2

CITY, ST 99999-9999

Important Information, Immediate Reply Requested

We recently found that wage reports you submitted for your employees may not be correct. We need your

help to correct them.

Each year we check our wage totals for the Forms W-2 you send us against the Forms 941, 943, 944 or

Schedule H (Form 1040) employment tax returns you file with the Internal Revenue Service (IRS).

What We Found

The W-2/W-2c totals we processed (Social Security wages and tips, and Medicare wages and tips) did not

match the totals you reported to the IRS for the EIN and tax year above. (See questionnaire enclosed).

There may be several reasons why these totals do not match. Most often, it is because we have not

received all the Forms W-2 that are due, or smaller W-2 wage amounts were reported to SSA than what

you reported to the IRS on your Forms 941, 943, 944 or Schedule H (Form 1040).

What You Should Do

Please check your records. Make sure you have correctly reported your employees' wages. See if there is

any other reason for the different wage totals. Then, fill out the enclosed questionnaire and return it within

45 days.

NOTE: SSA no longer accepts magnetic media submissions. We encourage you to file your wage reports

electronically, using Business Services Online (BSO). You can find more information on wage report

filing by going to our employer reporting website at:

Enclosure(s):

Pub 16-002

Return Envelope

See Next Page

999999999-99-MMDDYY

SSA-L-93-SM (04-11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7