Florida Mortgage Brokerage Fee Agreement Form

ADVERTISEMENT

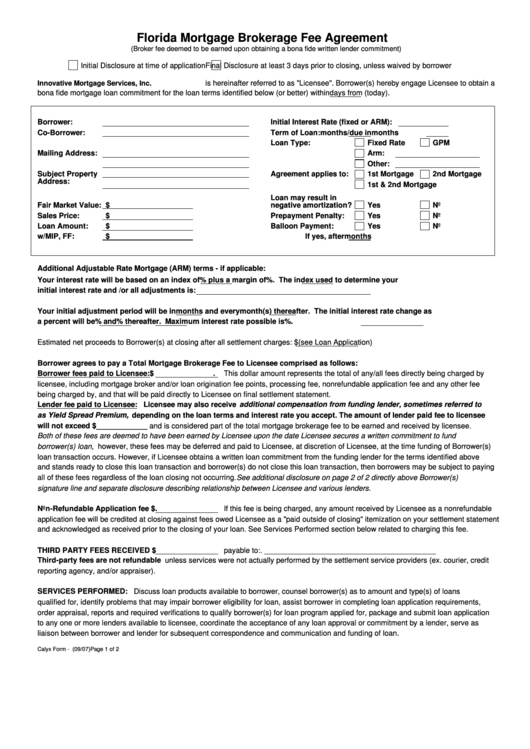

Florida Mortgage Brokerage Fee Agreement

(Broker fee deemed to be earned upon obtaining a bona fide written lender commitment)

Initial Disclosure at time of application

Final Disclosure at least 3 days prior to closing, unless waived by borrower

is hereinafter referred to as "Licensee". Borrower(s) hereby engage Licensee to obtain a

Innovative Mortgage Services, Inc.

bona fide mortgage loan commitment for the loan terms identified below (or better) within

days from (today).

Borrower:

Initial Interest Rate (fixed or ARM):

Co-Borrower:

Term of Loan:

months/due in

months

Loan Type:

Fixed Rate

GPM

Mailing Address:

Arm:

Other:

Subject Property

Agreement applies to:

1st Mortgage

2nd Mortgage

Address:

1st & 2nd Mortgage

Loan may result in

Fair Market Value:

$

negative amortization?

Yes

No

Sales Price:

$

Prepayment Penalty:

Yes

No

Loan Amount:

$

Balloon Payment:

Yes

No

w/MIP, FF:

$

If yes, after

months

Additional Adjustable Rate Mortgage (ARM) terms - if applicable:

Your interest rate will be based on an index of

% plus a margin of

%. The index used to determine your

initial interest rate and /or all adjustments is:

Your initial adjustment period will be in

months and every

month(s) thereafter. The initial interest rate change as

a percent will be

% and

% thereafter. Maximum interest rate possible is

%.

Estimated net proceeds to Borrower(s) at closing after all settlement charges: $

(see Loan Application)

Borrower agrees to pay a Total Mortgage Brokerage Fee to Licensee comprised as follows:

Borrower fees paid to Licensee: $

.

This dollar amount represents the total of any/all fees directly being charged by

licensee, including mortgage broker and/or loan origination fee points, processing fee, nonrefundable application fee and any other fee

being charged by, and that will be paid directly to Licensee on final settlement statement.

Lender fee paid to Licensee: Licensee may also receive

additional compensation from funding lender, sometimes referred to

as Yield Spread Premium,

depending on the loan terms and interest rate you accept. The amount of lender paid fee to licensee

will not exceed $____________

and is considered part of the total mortgage brokerage fee to be earned and received by licensee.

Both of these fees are deemed to have been earned by Licensee upon the date Licensee secures a written commitment to fund

borrower(s) loan,

however, these fees may be deferred and paid to Licensee, at discretion of Licensee, at the time funding of Borrower(s)

loan transaction occurs. However, if Licensee obtains a written loan commitment from the funding lender for the terms identified above

and stands ready to close this loan transaction and borrower(s) do not close this loan transaction, then borrowers may be subject to paying

all of these fees regardless of the loan closing not occurring.

See additional disclosure on page 2 of 2 directly above Borrower(s)

signature line and separate disclosure describing relationship between Licensee and various lenders.

Non-Refundable Application fee $

.

If this fee is being charged, any amount received by Licensee as a nonrefundable

application fee will be credited at closing against fees owed Licensee as a "paid outside of closing" itemization on your settlement statement

and acknowledged as received prior to the closing of your loan. See Services Performed section below related to charging this fee.

THIRD PARTY FEES RECEIVED $

payable to:

.

Third-party fees are not refundable

unless services were not actually performed by the settlement service providers (ex. courier, credit

reporting agency, and/or appraiser).

SERVICES PERFORMED:

Discuss loan products available to borrower, counsel borrower(s) as to amount and type(s) of loans

qualified for, identify problems that may impair borrower eligibility for loan, assist borrower in completing loan application requirements,

order appraisal, reports and required verifications to qualify borrower(s) for loan program applied for, package and submit loan application

to any one or more lenders available to licensee, coordinate the acceptance of any loan approval or commitment by a lender, serve as

liaison between borrower and lender for subsequent correspondence and communication and funding of loan.

Calyx Form - flmbbc.frm (09/07)

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2