Unemployment Tax Credit Kt 740

Download a blank fillable Unemployment Tax Credit Kt 740 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Unemployment Tax Credit Kt 740 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

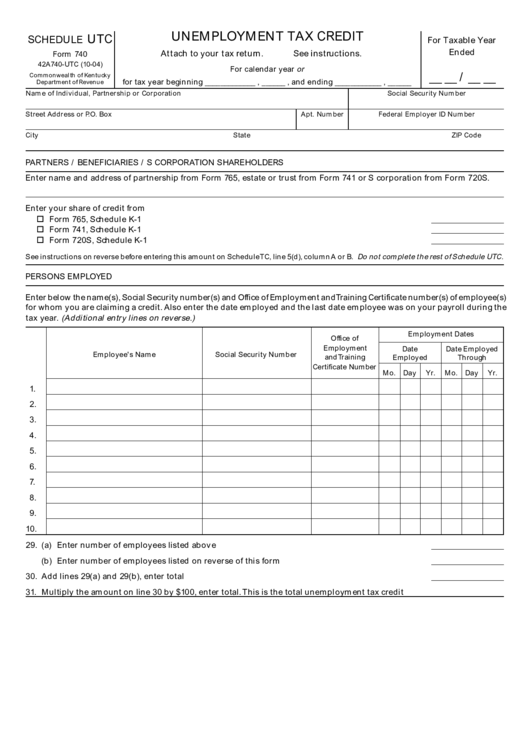

UNEMPLOYMENT TAX CREDIT

UTC

SCHEDULE

For Taxable Year

Ended

Attach to your tax return.

See instructions.

Form 740

42A740-UTC (10-04)

For calendar year or

__ __ / __ __

Commonwealth of Kentucky

for tax year beginning _____________ , ______ , and ending ____________ , ______

Department of Revenue

Name of Individual, Partnership or Corporation

Social Security Number

Street Address or P .O. Box

Apt. Number

Federal Employer ID Number

City

State

ZIP Code

PARTNERS / BENEFICIARIES / S CORPORATION SHAREHOLDERS

Enter name and address of partnership from Form 765, estate or trust from Form 741 or S corporation from Form 720S.

Enter your share of credit from

Form 765, Schedule K-1 ..........................................................................................................................

Form 741, Schedule K-1 ..........................................................................................................................

Form 720S, Schedule K-1 ........................................................................................................................

See instructions on reverse before entering this amount on Schedule TC, line 5(d), column A or B. Do not complete the rest of Schedule UTC.

PERSONS EMPLOYED

Enter below the name(s), Social Security number(s) and Office of Employment and Training Certificate number(s) of employee(s)

for whom you are claiming a credit. Also enter the date employed and the last date employee was on your payroll during the

tax year. (Additional entry lines on reverse.)

Employment Dates

Office of

Employment

Date

Date Employed

Employee's Name

Social Security Number

and Training

Employed

Through

Certificate Number

Mo. Day

Yr.

Mo. Day

Yr.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

29. (a) Enter number of employees listed above ..........................................................................................

(b) Enter number of employees listed on reverse of this form ..............................................................

30. Add lines 29(a) and 29(b), enter total ........................................................................................................

31. Multiply the amount on line 30 by $100, enter total. This is the total unemployment tax credit .........

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2