Attorney Income And Expense Worksheet

ADVERTISEMENT

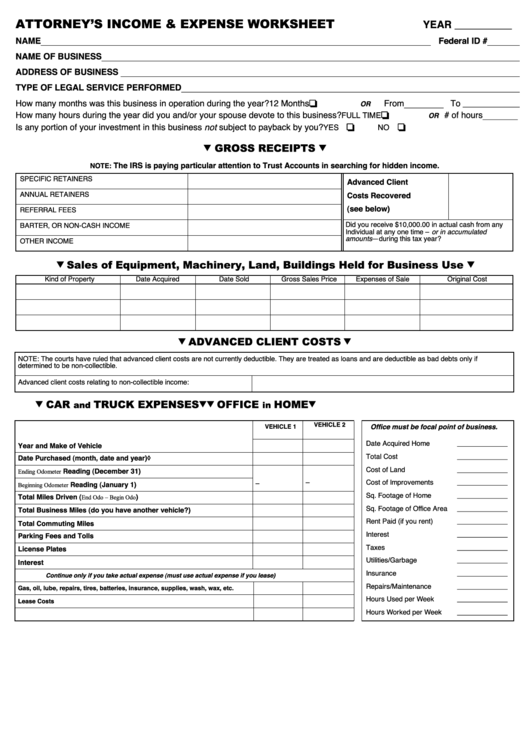

ATTORNEY’S INCOME & EXPENSE WORKSHEET

YEAR __________

NAME_________________________________________________________________________________________ Federal ID # ______________________________

NAME OF BUSINESS ______________________________________________________________________________________________________________________

ADDRESS OF BUSINESS _________________________________________________________________________________________________________________

TYPE OF LEGAL SERVICE PERFORMED _______________________________________________________________________________________________

❏

How many months was this business in operation during the year?

12 Months

From_________ To _____________

OR

❏

# of hours ________

How many hours during the year did you and/or your spouse devote to this business?

FULL TIME

OR

❏

❏

Is any portion of your investment in this business not subject to payback by you?

YES

NO

GROSS RECEIPTS

The IRS is paying particular attention to Trust Accounts in searching for hidden income.

NOTE:

SPECIFIC RETAINERS

Advanced Client

ANNUAL RETAINERS

Costs Recovered

(see below)

REFERRAL FEES

Did you receive $10,000.00 in actual cash from any

BARTER, OR NON-CASH INCOME

Individual at any one time – or in accumulated

amounts —during this tax year?

OTHER INCOME

Sales of Equipment, Machinery, Land, Buildings Held for Business Use

Kind of Property

Date Acquired

Date Sold

Gross Sales Price

Expenses of Sale

Original Cost

ADVANCED CLIENT COSTS

NOTE: The courts have ruled that advanced client costs are not currently deductible. They are treated as loans and are deductible as bad debts only if

determined to be non-collectible.

Advanced client costs relating to non-collectible income:

CAR

TRUCK EXPENSES

OFFICE

HOME

and

in

VEHICLE 2

VEHICLE 1

Office must be focal point of business.

Date Acquired Home

_____________

Year and Make of Vehicle

Total Cost

_____________

Date Purchased (month, date and year)◊

Cost of Land

_____________

Ending Odometer

Reading (December 31)

–

Cost of Improvements

_____________

–

Beginning Odometer

Reading (January 1)

Sq. Footage of Home

_____________

Total Miles Driven (

End Odo – Begin Odo

)

Sq. Footage of Office Area

_____________

Total Business Miles (do you have another vehicle?)

Rent Paid (if you rent)

_____________

Total Commuting Miles

Interest

_____________

Parking Fees and Tolls

Taxes

_____________

License Plates

Utilities/Garbage

_____________

Interest

Insurance

_____________

Continue only if you take actual expense (must use actual expense if you lease)

Repairs/Maintenance

_____________

Gas, oil, lube, repairs, tires, batteries, insurance, supplies, wash, wax, etc.

Hours Used per Week

_____________

Lease Costs

Hours Worked per Week

_____________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2