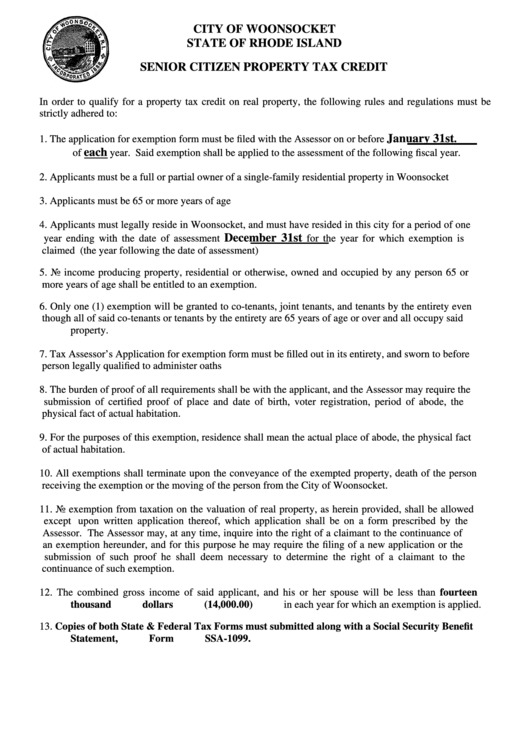

Senior Citizen Property Tax Credit

ADVERTISEMENT

CITY OF WOONSOCKET

STATE OF RHODE ISLAND

SENIOR CITIZEN PROPERTY TAX CREDIT

In order to qualify for a property tax credit on real property, the following rules and regulations must be

strictly adhered to:

January 31st

1.

The application for exemption form must be filed with the Assessor on or before

.

each

of

year. Said exemption shall be applied to the assessment of the following fiscal year.

2.

Applicants must be a full or partial owner of a single-family residential property in Woonsocket

3.

Applicants must be 65 or more years of age

4.

Applicants must legally reside in Woonsocket, and must have resided in this city for a period of one

December 31st

year ending with the date of assessment

for the year for which exemption is

claimed (the year following the date of assessment)

5.

No income producing property, residential or otherwise, owned and occupied by any person 65 or

more years of age shall be entitled to an exemption.

6.

Only one (1) exemption will be granted to co-tenants, joint tenants, and tenants by the entirety even

though all of said co-tenants or tenants by the entirety are 65 years of age or over and all occupy said

property.

7.

Tax Assessor’s Application for exemption form must be filled out in its entirety, and sworn to before

person legally qualified to administer oaths

8.

The burden of proof of all requirements shall be with the applicant, and the Assessor may require the

submission of certified proof of place and date of birth, voter registration, period of abode, the

physical fact of actual habitation.

9.

For the purposes of this exemption, residence shall mean the actual place of abode, the physical fact

of actual habitation.

10.

All exemptions shall terminate upon the conveyance of the exempted property, death of the person

receiving the exemption or the moving of the person from the City of Woonsocket.

11.

No exemption from taxation on the valuation of real property, as herein provided, shall be allowed

except upon written application thereof, which application shall be on a form prescribed by the

Assessor. The Assessor may, at any time, inquire into the right of a claimant to the continuance of

an exemption hereunder, and for this purpose he may require the filing of a new application or the

submission of such proof he shall deem necessary to determine the right of a claimant to the

continuance of such exemption.

12.

The combined gross income of said applicant, and his or her spouse will be less than fourteen

thousand dollars (14,000.00) in each year for which an exemption is applied.

13.

Copies of both State & Federal Tax Forms must submitted along with a Social Security Benefit

Statement, Form SSA-1099.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2