Instructions For 2010 Form 4cs: Sharing Of Research Credits For Combined Group Members

ADVERTISEMENT

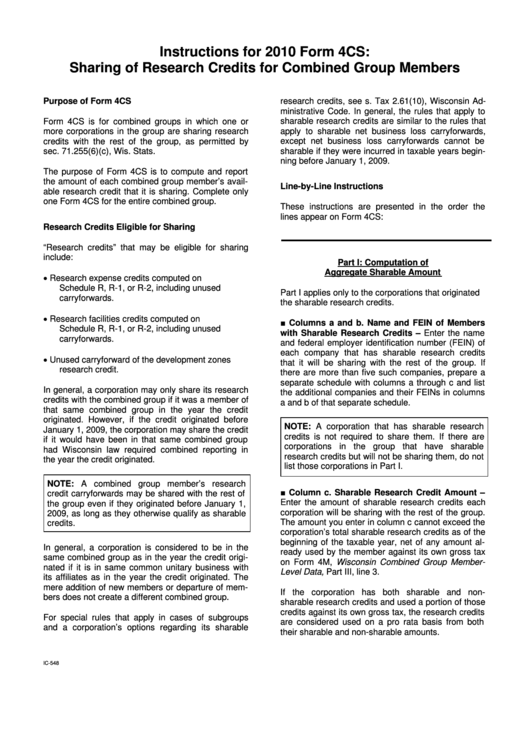

Instructions for 2010 Form 4CS:

Sharing of Research Credits for Combined Group Members

Purpose of Form 4CS

research credits, see s. Tax 2.61(10), Wisconsin Ad-

ministrative Code. In general, the rules that apply to

Form 4CS is for combined groups in which one or

sharable research credits are similar to the rules that

more corporations in the group are sharing research

apply to sharable net business loss carryforwards,

credits with the rest of the group, as permitted by

except net business loss carryforwards cannot be

sec. 71.255(6)(c), Wis. Stats.

sharable if they were incurred in taxable years begin-

ning before January 1, 2009.

The purpose of Form 4CS is to compute and report

the amount of each combined group member’s avail-

Line-by-Line Instructions

able research credit that it is sharing. Complete only

one Form 4CS for the entire combined group.

These instructions are presented in the order the

lines appear on Form 4CS:

Research Credits Eligible for Sharing

“Research credits” that may be eligible for sharing

include:

Part I: Computation of

Aggregate Sharable Amount

Research expense credits computed on

Schedule R, R-1, or R-2, including unused

Part I applies only to the corporations that originated

carryforwards.

the sharable research credits.

Research facilities credits computed on

■ Columns a and b. Name and FEIN of Members

Schedule R, R-1, or R-2, including unused

with Sharable Research Credits – Enter the name

carryforwards.

and federal employer identification number (FEIN) of

each company that has sharable research credits

Unused carryforward of the development zones

that it will be sharing with the rest of the group. If

research credit.

there are more than five such companies, prepare a

separate schedule with columns a through c and list

In general, a corporation may only share its research

the additional companies and their FEINs in columns

credits with the combined group if it was a member of

a and b of that separate schedule.

that same combined group in the year the credit

originated. However, if the credit originated before

NOTE: A corporation that has sharable research

January 1, 2009, the corporation may share the credit

credits is not required to share them. If there are

if it would have been in that same combined group

corporations in the group that have sharable

had Wisconsin law required combined reporting in

research credits but will not be sharing them, do not

the year the credit originated.

list those corporations in Part I.

NOTE: A combined group member’s research

■ Column c. Sharable Research Credit Amount –

credit carryforwards may be shared with the rest of

Enter the amount of sharable research credits each

the group even if they originated before January 1,

corporation will be sharing with the rest of the group.

2009, as long as they otherwise qualify as sharable

The amount you enter in column c cannot exceed the

credits.

corporation’s total sharable research credits as of the

beginning of the taxable year, net of any amount al-

In general, a corporation is considered to be in the

ready used by the member against its own gross tax

same combined group as in the year the credit origi-

on Form 4M, Wisconsin Combined Group Member-

nated if it is in same common unitary business with

Level Data, Part III, line 3.

its affiliates as in the year the credit originated. The

mere addition of new members or departure of mem-

If the corporation has both sharable and non-

bers does not create a different combined group.

sharable research credits and used a portion of those

credits against its own gross tax, the research credits

For special rules that apply in cases of subgroups

are considered used on a pro rata basis from both

and a corporation’s options regarding its sharable

their sharable and non-sharable amounts.

IC-548

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3