Reset Form

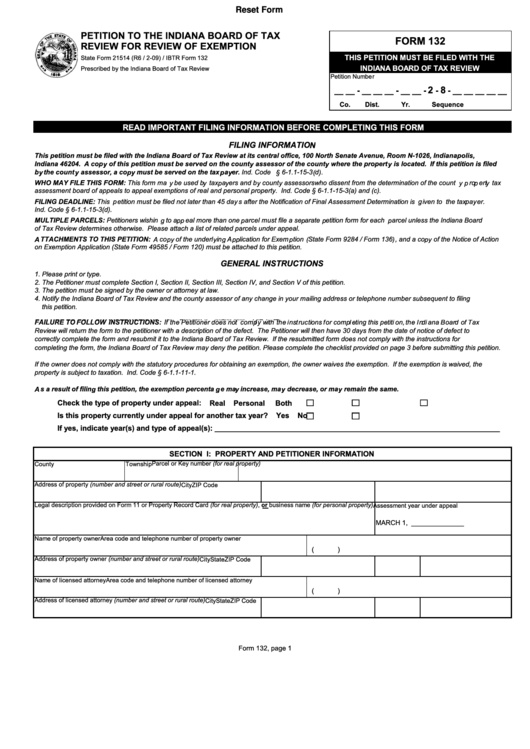

PETITION TO THE INDIANA BOARD OF TAX

FORM 132

REVIEW FOR REVIEW OF EXEMPTION

THIS PETITION MUST BE FILED WITH THE

State Form 21514 (R6 / 2-09) / IBTR Form 132

INDIANA BOARD OF TAX REVIEW

Prescribed by the Indiana Board of Tax Review

Petition Number

2

8

__ __ - __ __ __ - __ __ -

-

- __ __ __ __ __

Co.

Dist.

Yr.

Sequence

READ IMPORTANT FILING INFORMATION BEFORE COMPLETING THIS FORM

FILING INFORMATION

This petition must be filed with the Indiana Board of Tax Review at its central office, 100 North Senate Avenue, Room N-1026, Indianapolis,

Indiana 46204. A copy of this petition must be served on the county assessor of the county where the property is located. If this petition is filed

by the county assessor, a copy must be served on the taxpayer. Ind. Code § 6-1.1-15-3(d).

WHO MAY FILE THIS FORM: This form may be used by taxpayers and by county assessors who dissent from the determination of the county property tax

assessment board of appeals to appeal exemptions of real and personal property. Ind. Code § 6-1.1-15-3(a) and (c).

FILING DEADLINE: This petition must be filed not later than 45 days after the Notification of Final Assessment Determination is given to the taxpayer.

Ind. Code § 6-1.1-15-3(d).

MULTIPLE PARCELS: Petitioners wishing to appeal more than one parcel must file a separate petition form for each parcel unless the Indiana Board

of Tax Review determines otherwise. Please attach a list of related parcels under appeal.

ATTACHMENTS TO THIS PETITION: A copy of the underlying Application for Exemption (State Form 9284 / Form 136), and a copy of the Notice of Action

on Exemption Application (State Form 49585 / Form 120) must be attached to this petition.

GENERAL INSTRUCTIONS

1. Please print or type.

2. The Petitioner must complete Section I, Section II, Section III, Section IV, and Section V of this petition.

3. The petition must be signed by the owner or attorney at law.

4. Notify the Indiana Board of Tax Review and the county assessor of any change in your mailing address or telephone number subsequent to filing

this petition.

FAILURE TO FOLLOW INSTRUCTIONS If th P titi

FAILURE TO FOLLOW INSTRUCTIONS: If the Petitioner does not comply with the instructions for completing this petition, the Indiana Board of Tax

d

t

l

ith th i

t

ti

f

l ti

thi

titi

th I di

B

d f T

Review will return the form to the petitioner with a description of the defect. The Petitioner will then have 30 days from the date of notice of defect to

correctly complete the form and resubmit it to the Indiana Board of Tax Review. If the resubmitted form does not comply with the instructions for

completing the form, the Indiana Board of Tax Review may deny the petition. Please complete the checklist provided on page 3 before submitting this petition.

If the owner does not comply with the statutory procedures for obtaining an exemption, the owner waives the exemption. If the exemption is waived, the

property is subject to taxation. Ind. Code § 6-1.1-11-1.

As a result of filing this petition, the exemption percentage may increase, may decrease, or may remain the same.

Check the type of property under appeal:

Real

Personal

Both

Is this property currently under appeal for another tax year?

Yes

No

If yes, indicate year(s) and type of appeal(s): _____________________________________________________________________

SECTION I: PROPERTY AND PETITIONER INFORMATION

Parcel or Key number (for real property)

County

Township

Address of property (number and street or rural route)

City

ZIP Code

Legal description provided on Form 11 or Property Record Card (for real property) , or business name (for personal property) Assessment year under appeal

MARCH 1, ______________

Name of property owner

Area code and telephone number of property owner

(

)

Address of property owner (number and street or rural route)

City

State

ZIP Code

Name of licensed attorney

Area code and telephone number of licensed attorney

(

)

Address of licensed attorney (number and street or rural route)

City

State

ZIP Code

Form 132, page 1

1

1 2

2 3

3