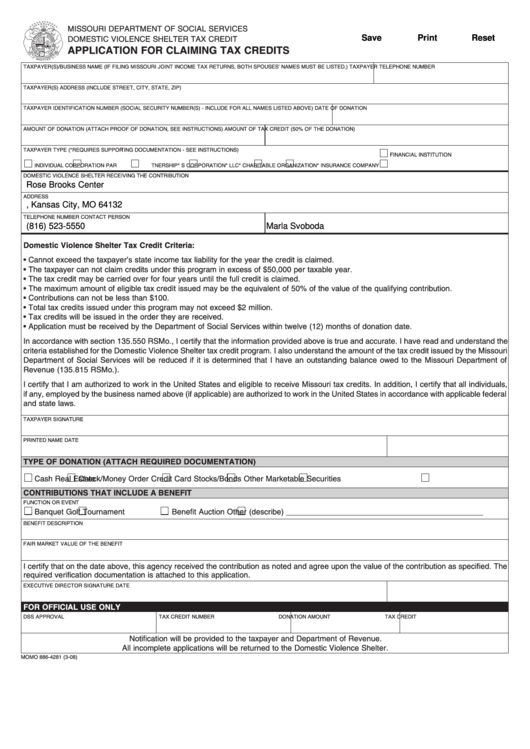

MISSOURI DEPARTMENT OF SOCIAL SERVICES

Save

Print

Reset

DOMESTIC VIOLENCE SHELTER TAX CREDIT

APPLICATION FOR CLAIMING TAX CREDITS

TAXPAYER(S)/BUSINESS NAME (IF FILING MISSOURI JOINT INCOME TAX RETURNS, BOTH SPOUSES’ NAMES MUST BE LISTED.)

TAXPAYER TELEPHONE NUMBER

TAXPAYER(S) ADDRESS (INCLUDE STREET, CITY, STATE, ZIP)

TAXPAYER IDENTIFICATION NUMBER (SOCIAL SECURITY NUMBER(S) - INCLUDE FOR ALL NAMES LISTED ABOVE)

DATE OF DONATION

AMOUNT OF DONATION (ATTACH PROOF OF DONATION, SEE INSTRUCTIONS)

AMOUNT OF TAX CREDIT (50% OF THE DONATION)

TAXPAYER TYPE (*REQUIRES SUPPOR

TING DOCUMENTATION - SEE INSTRUCTIONS)

FINANCIAL INSTITUTION

INDIVIDUAL

CORPORATION

PAR

TNERSHIP*

S CORPORATION*

LLC*

CHARITABLE ORGANIZATION*

INSURANCE COMPANY

DOMESTIC VIOLENCE SHELTER RECEIVING THE CONTRIBUTION

Rose Brooks Center

ADDRESS

P.O. Box 320599, Kansas City, MO 64132

TELEPHONE NUMBER

CONTACT PERSON

(816) 523-5550

Marla Svoboda

Domestic Violence Shelter Tax Credit Criteria:

• Cannot exceed the taxpayer’s state income tax liability for the year the credit is claimed.

• The taxpayer can not claim credits under this program in excess of $50,000 per taxable year.

• The tax credit may be carried over for four years until the full credit is claimed.

• The maximum amount of eligible tax credit issued may be the equivalent of 50% of the value of the qualifying contribution.

• Contributions can not be less than $100.

• Total tax credits issued under this program may not exceed $2 million.

• Tax credits will be issued in the order they are received.

• Application must be received by the Department of Social Services within twelve (12) months of donation date.

In accordance with section 135.550 RSMo., I certify that the information provided above is true and accurate. I have read and understand the

criteria established for the Domestic Violence Shelter tax credit program. I also understand the amount of the tax credit issued by the Missouri

Department of Social Services will be reduced if it is determined that I have an outstanding balance owed to the Missouri Department of

Revenue (135.815 RSMo.).

I certify that I am authorized to work in the United States and eligible to receive Missouri tax credits. In addition, I certify that all individuals,

if any, employed by the business named above (if applicable) are authorized to work in the United States in accordance with applicable federal

and state laws.

TAXPAYER SIGNATURE

PRINTED NAME

DATE

TYPE OF DONATION (ATTACH REQUIRED DOCUMENTATION)

Cash

Check/Money Order

Credit Card

Stocks/Bonds

Other Marketable Securities

Real Estate

CONTRIBUTIONS THAT INCLUDE A BENEFIT

FUNCTION OR EVENT

Banquet

Golf Tournament

Benefit Auction

Other (describe) _____________________________________________

BENEFIT DESCRIPTION

FAIR MARKET VALUE OF THE BENEFIT

I certify that on the date above, this agency received the contribution as noted and agree upon the value of the contribution as specified. The

required verification documentation is attached to this application.

EXECUTIVE DIRECTOR SIGNATURE

DATE

FOR OFFICIAL USE ONLY

DSS APPROVAL

TAX CREDIT NUMBER

DONATION AMOUNT

TAX CREDIT

Notification will be provided to the taxpayer and Department of Revenue.

All incomplete applications will be returned to the Domestic Violence Shelter.

MO

MO 886-4281 (3-08)

1

1 2

2 3

3 4

4