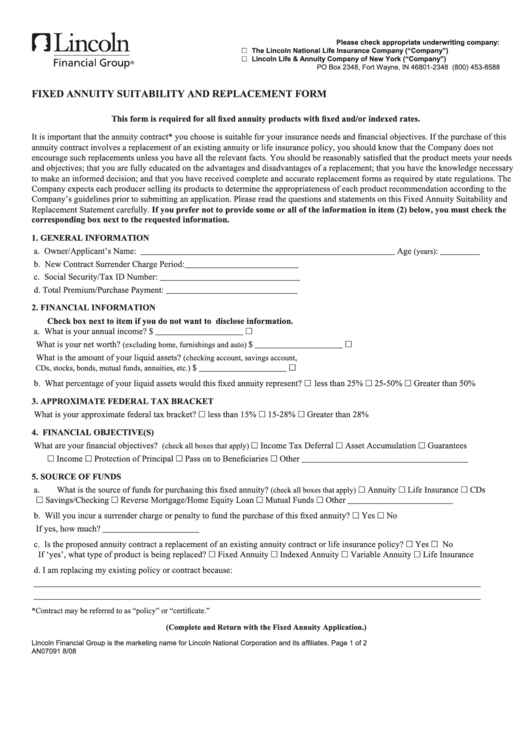

Please check appropriate underwriting company:

h The Lincoln National Life Insurance Company (“Company”)

h Lincoln Life & Annuity Company of New York (“Company”)

PO Box 2348, Fort Wayne, IN 46801-2348 (800) 453-8588

FIXED AnnuIty suItAbIlIty AnD rEplAcEmEnt FOrm

this form is required for all fixed annuity products with fixed and/or indexed rates.

It is important that the annuity contract* you choose is suitable for your insurance needs and financial objectives. If the purchase of this

annuity contract involves a replacement of an existing annuity or life insurance policy, you should know that the Company does not

encourage such replacements unless you have all the relevant facts. You should be reasonably satisfied that the product meets your needs

and objectives; that you are fully educated on the advantages and disadvantages of a replacement; that you have the knowledge necessary

to make an informed decision; and that you have received complete and accurate replacement forms as required by state regulations. The

Company expects each producer selling its products to determine the appropriateness of each product recommendation according to the

Company’s guidelines prior to submitting an application. Please read the questions and statements on this Fixed Annuity Suitability and

Replacement Statement carefully. If you prefer not to provide some or all of the information in item (2) below, you must check the

corresponding box next to the requested information.

1. GEnErAl InFOrmAtIOn

a. Owner/Applicant’s Name: __________________________________________________________

Age

: _________

(years)

b. New Contract Surrender Charge Period:__________________________

c. Social Security/Tax ID Number: ________________________________

d. Total Premium/Purchase Payment: ______________________________

2. FInAncIAl InFOrmAtIOn

check box next to item if you do not want to disclose information.

a. What is your annual income?

$ ____________________ h

What is your net worth?

$ ____________________ h

(excluding home, furnishings and auto)

What is the amount of your liquid assets?

(checking account, savings account,

$ ____________________ h

CDs, stocks, bonds, mutual funds, annuities, etc.)

b. What percentage of your liquid assets would this fixed annuity represent? h less than 25% h 25-50% h Greater than 50%

3. ApprOXImAtE FEDErAl tAX brAcKEt

What is your approximate federal tax bracket?

h less than 15%

h 15-28%

h Greater than 28%

4. FInAncIAl ObJEctIVE(s)

What are your financial objectives?

h Income Tax Deferral h Asset Accumulation h Guarantees

(check all boxes that apply)

h Income

h Protection of Principal

h Pass on to Beneficiaries

h Other ______________________________________

5. sOurcE OF FunDs

a. What is the source of funds for purchasing this fixed annuity?

h Annuity h Life Insurance h CDs

(check all boxes that apply)

h Savings/Checking

h Reverse Mortgage/Home Equity Loan h Mutual Funds

h Other ________________________

b. Will you incur a surrender charge or penalty to fund the purchase of this fixed annuity? h Yes h No

If yes, how much? ______________________

c. Is the proposed annuity contract a replacement of an existing annuity contract or life insurance policy? h Yes h No

If ‘yes’, what type of product is being replaced? h Fixed Annuity h Indexed Annuity h Variable Annuity h Life Insurance

d. I am replacing my existing policy or contract because:

______________________________________________________________________________________________________

______________________________________________________________________________________________________

*Contract may be referred to as “policy” or “certificate.”

(complete and return with the Fixed Annuity Application.)

Lincoln Financial Group is the marketing name for Lincoln National Corporation and its affiliates.

Page 1 of 2

AN07091

8/08

1

1 2

2