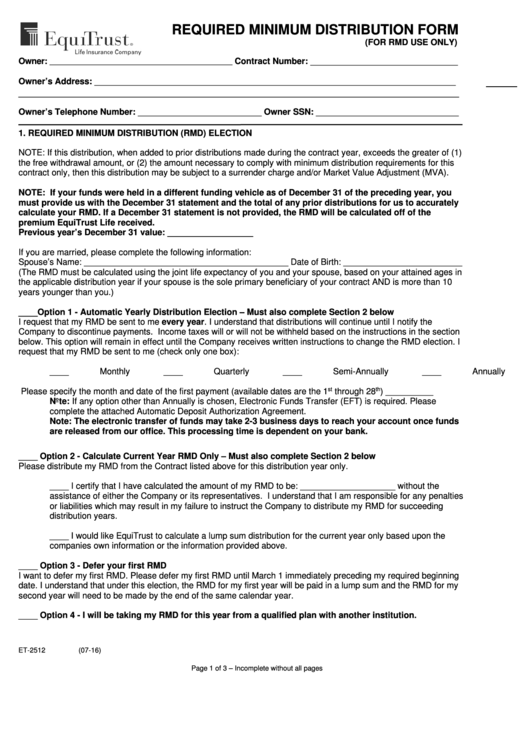

REQUIRED MINIMUM DISTRIBUTION FORM

(FOR RMD USE ONLY)

Owner: __________________________________________ Contract Number: _______________________________

Owner’s Address: ____________________________________________________________________________

____________________________________________________________________________________

Owner’s Telephone Number: __________________________ Owner SSN: ______________________________

1. REQUIRED MINIMUM DISTRIBUTION (RMD) ELECTION

NOTE: If this distribution, when added to prior distributions made during the contract year, exceeds the greater of (1)

the free withdrawal amount, or (2) the amount necessary to comply with minimum distribution requirements for this

contract only, then this distribution may be subject to a surrender charge and/or Market Value Adjustment (MVA).

NOTE: If your funds were held in a different funding vehicle as of December 31 of the preceding year, you

must provide us with the December 31 statement and the total of any prior distributions for us to accurately

calculate your RMD. If a December 31 statement is not provided, the RMD will be calculated off of the

premium EquiTrust Life received.

Previous year’s December 31 value: __________________

If you are married, please complete the following information:

Spouse’s Name: ___________________________________________ Date of Birth: _________________________

(The RMD must be calculated using the joint life expectancy of you and your spouse, based on your attained ages in

the applicable distribution year if your spouse is the sole primary beneficiary of your contract AND is more than 10

years younger than you.)

____Option 1 - Automatic Yearly Distribution Election – Must also complete Section 2 below

I request that my RMD be sent to me every year. I understand that distributions will continue until I notify the

Company to discontinue payments. Income taxes will or will not be withheld based on the instructions in the section

below. This option will remain in effect until the Company receives written instructions to change the RMD election. I

request that my RMD be sent to me (check only one box):

____ Monthly

____ Quarterly

____ Semi-Annually

____ Annually

st

th

through 28

) __________

Please specify the month and date of the first payment (available dates are the 1

Note: If any option other than Annually is chosen, Electronic Funds Transfer (EFT) is required. Please

complete the attached Automatic Deposit Authorization Agreement.

Note: The electronic transfer of funds may take 2-3 business days to reach your account once funds

are released from our office. This processing time is dependent on your bank.

____ Option 2 - Calculate Current Year RMD Only – Must also complete Section 2 below

Please distribute my RMD from the Contract listed above for this distribution year only.

____ I certify that I have calculated the amount of my RMD to be: ____________________ without the

assistance of either the Company or its representatives. I understand that I am responsible for any penalties

or liabilities which may result in my failure to instruct the Company to distribute my RMD for succeeding

distribution years.

____ I would like EquiTrust to calculate a lump sum distribution for the current year only based upon the

companies own information or the information provided above.

____ Option 3 - Defer your first RMD

I want to defer my first RMD. Please defer my first RMD until March 1 immediately preceding my required beginning

date. I understand that under this election, the RMD for my first year will be paid in a lump sum and the RMD for my

second year will need to be made by the end of the same calendar year.

____ Option 4 - I will be taking my RMD for this year from a qualified plan with another institution.

ET-2512 (07-16)

Page 1 of 3 – Incomplete without all pages

1

1 2

2 3

3 4

4