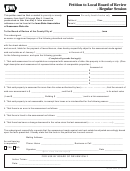

PROTEST OF ASSESSMENT TO LOCAL BOARD OF REVIEW

SPECIAL EQUALIZATION SESSION

Iowa Code section 441.49 provides that the Director of Revenue issue final equalization orders by October 1 of each

odd-numbered year.

Any property owner who is dissatisfied with his or her assessment as a result of the Director’s equalization order may

protest such assessment to the local board of review.

It is the responsibility of the property owner to present facts to the board of review indicating that the application of the

equalization order results in an assessed value greater than is authorized by Section 441.21 of the Iowa Code. This

portion of the Iowa Code stipulates that all property, except agricultural realty, be assessed at “market” value.

Agricultural property is to be assessed according to its productivity and net earning capacity.

This petition to the board of review is to be completed and submitted to the board of review from October 16 through

October 25 of the year in which the equalization order is issued.

The board of review may adjust all or a part of the percentage increase ordered by the Director of Revenue by adjusting

the actual value of the property under protest to 100 percent of actual value. The board of review cannot in equalization

session consider classification, exemption or other issues not related to equalization increase.

Section 441.21, provides that,

“The burden of proof shall be upon any complainant attacking such valuations as excessive, inadequate,

inequitable or capricious; however, in protest or appeal proceedings when the complainant offers competent

evidence by at least two disinterested witnesses that the market value of the property is less than the market

value determined by the assessor, the burden of proof thereafter shall be upon the officials or persons

seeking to uphold such valuations to be assessed.”

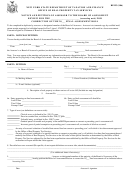

Section 441.37A Appeal of protest to property assessment appeal board.

1. Appeals may be taken from the action of the board of review with reference to protests of assessment,

valuation, or application of an equalization order to the property assessment appeal board created in

section 421.1A. However, a property owner or aggrieved taxpayer or an appellant described in section

441.42 may bypass the property assessment appeal board and appeal the decision of the local board

of review to the district court pursuant to section 441.38. For an appeal to the property assessment

appeal board to be valid, written notice must be filed with the secretary of the property assessment

appeal board within twenty days after the date the board of review’s letter of disposition of the appeal is

postmarked to the party making the protest. The written notice of appeal shall include a petition setting

forth the basis of the appeal and the relief sought.

Section 441.38 Appeal to district court.

1. Appeals may be taken from the action of the board of review with reference to protests of assessments,

to the district court of the county in which the board holds its sessions within twenty days after its

adjournment... . No new grounds in addition to those set out in the protest to the board of review as

provided in section 441.37 can be pleaded, but additional evidence to sustain those grounds may be

introduced. The assessor shall have the same right to appeal and in the same manner as an individual

taxpayer, public body or other public officer as provided in section 441.42. Appeals shall be taken by

filing a written notice of appeal with the clerk of district court. Filing of the written notice of appeal shall

preserve all rights of appeal of the appellant.

2. Notice of appeal shall be served as an original notice on the chairperson, presiding officer, or clerk of

the board of review after the filing of notice under subsection 1 with the clerk of district court.

Section 441.39 Trial on Appeal

1. If the appeal is from a decision of the local board of review, the court shall hear the appeal in equity

and determine anew all questions arising before the board which relate to the liability of the property to

assessment or the amount thereof. The court shall consider all of the evidence and there shall be no

presumption as to the correctness of the valuation or assessment appealed from. If the appeal is from

a decision of the property assessment appeal board, the court’s review shall be limited to the correction

of errors at law.

56-065b (8/27/07)

1

1 2

2