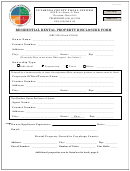

Supplement To The New Residential Rental Property Rebate Application

ADVERTISEMENT

Clear Data

Help

Protected B

when completed

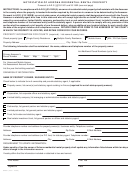

Supplement to the New Residential Rental Property

Rebate Application – Co-op and Multiple Units

Use this form if you are a co-operative housing corporation (co-op) or if you purchased, constructed, substantially renovated, or made an

addition (consisting of more than one residential unit) to a multiple unit residential complex, or if you converted a commercial property into a

multiple unit residential complex. You also have to complete sections A, B, C, and F of Form GST524, GST/HST New Residential Rental

Property Rebate Application, and send us the two forms together.

If you purchased the residential complex, and the purchase included real property that does not form part of the complex, you have to separate

out any part of the tax paid from the purchase price that was for any non-residential part of the property. For example, do not include any tax

that relates to retail stores that form part of the building. The allocation must be fair and reasonable.

Whether you are a purchaser or builder of a residential complex, do not include any amounts in your rebate calculation that are for the

non-residential part. You also have to establish the fair market value of the residential complex part of the property. This means that the

amounts you enter on lines A, B, C, D, E and F must only be for the residential part of the property.

Which calculation should I complete?

Type 6 – Lease of building and land / Type 7 – Sale of building and lease of land

Complete one Form GST524 and one form GST525 to include all of the qualifying residential units in a multiple unit residential complex.

Complete Section A and all parts of Section B on pages 1 and 2 of Form GST525.

Type 8 – Co-operative housing corporation

Complete one Form GST524 and one Form GST525 for each qualifying residential unit in the residential complex whether it is a single unit

residential complex or a multiple unit residential complex. Complete Section A on this page and Section C on pages 3 and 4 of Form GST525.

For more information, see Guide RC4231, GST/HST New Residential Rental Property Rebate, go to , or call

1-800-959-5525.

Section A – Claimant information

Claimant's legal name (last name, first name, and initial(s) for individuals)

Business Number (if applicable)

R T

Section B – Rebate calculation for Type 6 and Type 7

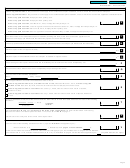

Part I – Rebate calculation for units in a multiple unit residential complex or addition

If you paid the GST on the purchase or self-supply of the residential complex or addition, enter on line A the amount of the GST paid.

If you paid the HST on the purchase or self-supply of the residential complex or addition, enter on line A the result of the applicable calculation below:

If you paid 12% HST, multiply the HST paid by 5/12.

If you paid 13% HST, multiply the HST paid by 5/13.

If you paid 14% HST after March 31, 2013, multiply the HST paid by 5/14.

A

$

If you paid 14% HST, under an agreement entered into before October 31, 2007, multiply the HST paid by 6/14.

If you paid 15% HST after June 30, 2010, multiply the HST paid by 5/15.

If you paid 15% HST under an agreement entered into before May 3, 2006, multiply the HST paid by 7/15.

Fair market value of the residential complex or addition (building and land) at the time tax became payable on the

B

$

purchase or self-supply (do not include the GST/HST payable on the fair market value).

If you are claiming a rebate under Type 6 and you purchased the residential complex, enter the purchase price of the

C

$

complex (do not include the GST/HST).

D

Multiply line A by 36%.

$

E

Square metres of floor space for all residential units in the complex or addition (do not include common areas).

m

2

Tick the applicable box and enter the indicated amount on line F.

If you paid the GST at 5%, or HST at 12% or 13%, or if you paid 14% HST after March 31, 2013, or if you paid the

HST at 15% after June 30, 2010, on the purchase or self-supply of the residential complex or addition, enter $6,300.

F

$

If you paid 6% GST or 14% HST on the purchase or self-supply of the residential complex or addition under an

agreement entered into before October 31, 2007, enter $7,560.

If you paid 7% GST or 15% HST on the purchase or self-supply of the residential complex or addition under an

agreement entered into before May 3, 2006, enter $8,750.

G

Total number of qualifying residential units, (enter the amount from line G in Part III on page 2 of this form).

H

$

GST/HST new residential rental property rebate (enter the amount from line H in Part III on page 2 of this form).

Provincial new residential rental property rebate amount (if you are eligible, complete the calculation on the applicable

I

$

provincial rebate schedule and enter the result on line I).

J

$

Total rebate amount (including any provincial rebate) (line H plus line I).

(Vous pouvez obtenir ce formulaire en français à ou en composant le 1-800-959-7775.)

GST525 E (13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4