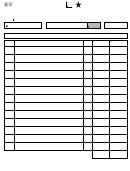

INSTRUCTIONS FOR COMPLETING THE HOTEL OCCUPANCY TAX REPORT

LINE 1. Enter the total amount of all room receipts during the reporting period. (Note that the City of Houston does not impose hotel

occupancy taxes on meeting rooms or banquet rooms.)

LINE 2. Enter the total amount of receipts for guests claiming a 30-day residency exemption. If no such exemptions are claimed,

enter "0".

LINE 3. Enter the total amount of all other exemptions claimed by guests. (Note that the City of Houston does not recognize State of

Texas exemptions for educational, religious, or charitable organizations.) If no exemptions are claimed, enter "0".

LINE 4.

Add

the exemptions on Line 2 and the exemptions on Line 3. Enter the total on Line 4.

LINE 5.

Subtract

the total exemptions on Line 4 from the amount of gross receipts on Line 1. Enter the difference on Line 5.

LINE 6.

Multiply

the taxable receipts on Line 5 by the applicable tax rate of seven percent (7%). Enter the tax owed on Line 6.

LINE 7. If the amount of tax owed is paid after the due date, simple interest will apply at a rate of ten percent (10%) per annum.

multiply

Interest is assessed daily beginning the first calendar day after the due date. If applicable,

Line 6 by .1 by ("X"/365), where "X"

is equal to the number of days after the due date. Enter the amount on Line 8.

LINE 8. If the amount of tax owed is more than three months past due, a fifteen percent (15%) penalty is assessed. If applicable,

multiply

Line 6 by .15 and enter the amount on Line 7.

LINE 9.

Add

the amounts owed on Line 6, Line 7 and Line 8. Enter the total on Line 9.

FREQUENTLY ASKED QUESTIONS

Who is required to report and remit the tax?

The tax must be reported and remitted by any individual or entity owning, operating, managing, or controlling a hotel within the

corporate limits of the City of Houston. The term “hotel” includes motels, tourist homes, tourist courts, lodging houses, boarding

houses, inns, rooming houses, or other buildings where rooms are provided for consideration of two dollars or more per day.

When are reports and payments due?

Reports and payments are due quarterly and must be received or postmarked by the last day of the month following the appropriate

quarter:

1st Quarter (Jan. -Mar.) due by April 30th;

2nd Quarter (Apr. -Jun.) due by July 31st;

3rd Quarter (Jul. -Sep.) due by October 31st;

4th Quarter (Oct. -Dec.) due by January 31st.

A report must be filed for every quarter, even if there is no tax due.

What happens if a report or payment is not submitted on time?

Failure to file a report or pay the amount of tax owed when due will result in an assessment of interest at the rate of 10% per annum,

as well as a one-time 15% penalty for amounts due for at least one municipal fiscal quarter (i.e., 3 months). If a lawsuit is filed to collect

unpaid taxes, a temporary injunction may be granted to prevent the hotel from operating until the amount owed is paid in full.

What forms of payment are accepted?

City of

Houston.

Payment may be made by check, money order or cashier's check. All payments must be made payable to the

Do you have a physical address?

Reports and payments may be sent to Houston First Corporation, Attn: Tax Office, 1001 Avenida de las Americas, Houston, TX 77010.

Who do I contact with questions?

Questions regarding the collection and reporting of the City of Houston Hotel Occupancy Tax should be directed to our tax office at

.

DS-062613

Visit us online at

1

1 2

2