Spending Percentage Guidelines

ADVERTISEMENT

Spending Percentage Guidelines

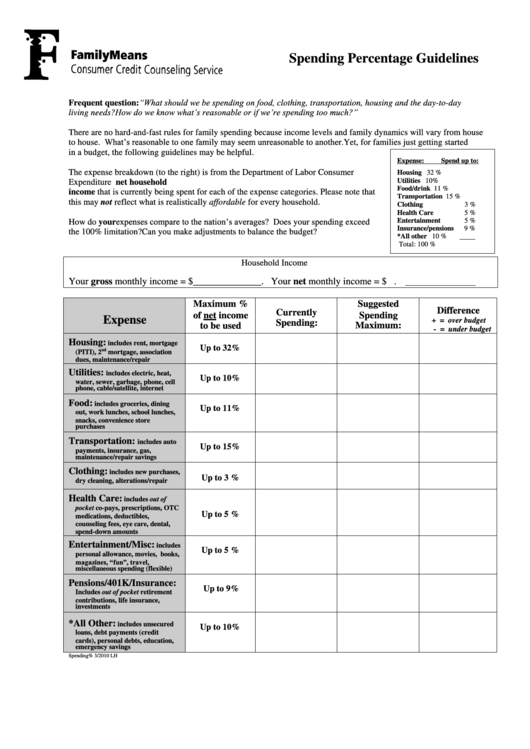

Frequent question: “What should we be spending on food, clothing, transportation, housing and the day-to-day

living needs? How do we know what’s reasonable or if we’re spending too much?”

There are no hard-and-fast rules for family spending because income levels and family dynamics will vary from house

to house. What’s reasonable to one family may seem unreasonable to another.

Yet, for families just getting started

in a budget, the following guidelines may be helpful.

Expense:

Spend up to:

The expense breakdown (to the right) is from the Department of Labor Consumer

Housing

32 %

Utilities

10%

Expenditure Survey. The information reflects the average percentage of net household

Food/drink

11 %

income that is currently being spent for each of the expense categories. Please note that

Transportation

15 %

this may not reflect what is realistically affordable for every household.

Clothing

3 %

Health Care

5 %

How do your expenses compare to the nation’s averages? Does your spending exceed

Entertainment

5 %

Insurance/pensions

9 %

the 100% limitation? Can you make adjustments to balance the budget?

*All other

10 %

Total:

100 %

Household Income

Your gross monthly income = $______________.

Your net monthly income = $

.

Maximum %

Suggested

Difference

Currently

of net income

Spending

Expense

+ = over budget

Spending:

to be used

Maximum:

- = under budget

Housing:

includes rent, mortgage

Up to 32%

nd

(PITI), 2

mortgage, association

dues, maintenance/repair

Utilities:

includes electric, heat,

Up to 10%

water, sewer, garbage, phone, cell

phone, cable/satellite, internet

Food:

includes groceries, dining

Up to 11%

out, work lunches, school lunches,

snacks, convenience store

purchases

Transportation:

includes auto

Up to 15%

payments, insurance, gas,

maintenance/repair savings

Clothing:

includes new purchases,

Up to 3 %

dry cleaning, alterations/repair

Health Care:

includes out of

pocket co-pays, prescriptions, OTC

Up to 5 %

medications, deductibles,

counseling fees, eye care, dental,

spend-down amounts

Entertainment/Misc:

includes

Up to 5 %

personal allowance, movies, books,

magazines, “fun”, travel,

miscellaneous spending (flexible)

Pensions/401K/Insurance:

Up to 9%

Includes out of pocket retirement

contributions, life insurance,

investments

*All Other:

includes unsecured

Up to 10%

loans, debt payments (credit

cards), personal debts, education,

emergency savings

Spending% 3/2010 LH

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1