Income Tax Worksheet - Village Of Germantown

ADVERTISEMENT

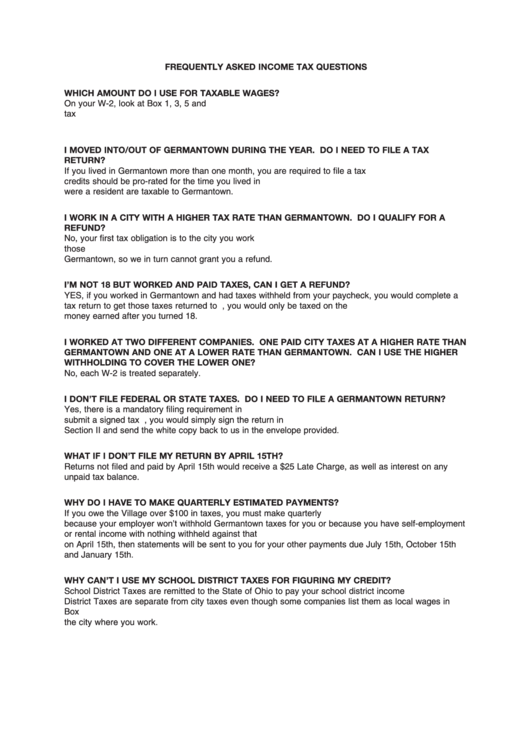

FREQUENTLY ASKED INCOME TAX QUESTIONS

WHICH AMOUNT DO I USE FOR TAXABLE WAGES?

On your W-2, look at Box 1, 3, 5 and 18. Box 5 will be used for your taxable wages on the Germantown

tax form. Local wages are usually in Box 18 with the tax paid in Box 19 and the location paid to in Box

20. These will be points of reference for information.

I MOVED INTO/OUT OF GERMANTOWN DURING THE YEAR. DO I NEED TO FILE A TAX

RETURN?

If you lived in Germantown more than one month, you are required to file a tax return. Your income and

credits should be pro-rated for the time you lived in Germantown. Only the wages earned while you

were a resident are taxable to Germantown.

I WORK IN A CITY WITH A HIGHER TAX RATE THAN GERMANTOWN. DO I QUALIFY FOR A

REFUND?

No, your first tax obligation is to the city you work in. You will receive a partial credit for taxes paid to

those cities. Any city that you work in keeps the tax money you pay them. This money is not paid to

Germantown, so we in turn cannot grant you a refund.

I’M NOT 18 BUT WORKED AND PAID TAXES, CAN I GET A REFUND?

YES, if you worked in Germantown and had taxes withheld from your paycheck, you would complete a

tax return to get those taxes returned to you. The year you turn 18, you would only be taxed on the

money earned after you turned 18.

I WORKED AT TWO DIFFERENT COMPANIES. ONE PAID CITY TAXES AT A HIGHER RATE THAN

GERMANTOWN AND ONE AT A LOWER RATE THAN GERMANTOWN. CAN I USE THE HIGHER

WITHHOLDING TO COVER THE LOWER ONE?

No, each W-2 is treated separately.

I DON’T FILE FEDERAL OR STATE TAXES. DO I NEED TO FILE A GERMANTOWN RETURN?

Yes, there is a mandatory filing requirement in Germantown. ALL residents over the age of 18 need to

submit a signed tax return. If you do not have taxable income, you would simply sign the return in

Section II and send the white copy back to us in the envelope provided.

WHAT IF I DON’T FILE MY RETURN BY APRIL 15TH?

Returns not filed and paid by April 15th would receive a $25 Late Charge, as well as interest on any

unpaid tax balance.

WHY DO I HAVE TO MAKE QUARTERLY ESTIMATED PAYMENTS?

If you owe the Village over $100 in taxes, you must make quarterly payments. This would usually be

because your employer won’t withhold Germantown taxes for you or because you have self-employment

or rental income with nothing withheld against that income. These payments are due with the tax return

on April 15th, then statements will be sent to you for your other payments due July 15th, October 15th

and January 15th.

WHY CAN’T I USE MY SCHOOL DISTRICT TAXES FOR FIGURING MY CREDIT?

School District Taxes are remitted to the State of Ohio to pay your school district income tax. School

District Taxes are separate from city taxes even though some companies list them as local wages in

Box 18. In this case you may have a second W-2 from your company to show how much tax was paid to

the city where you work.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2