County Of Kings - Personal Tax Exemption Form - 2016/2017

ADVERTISEMENT

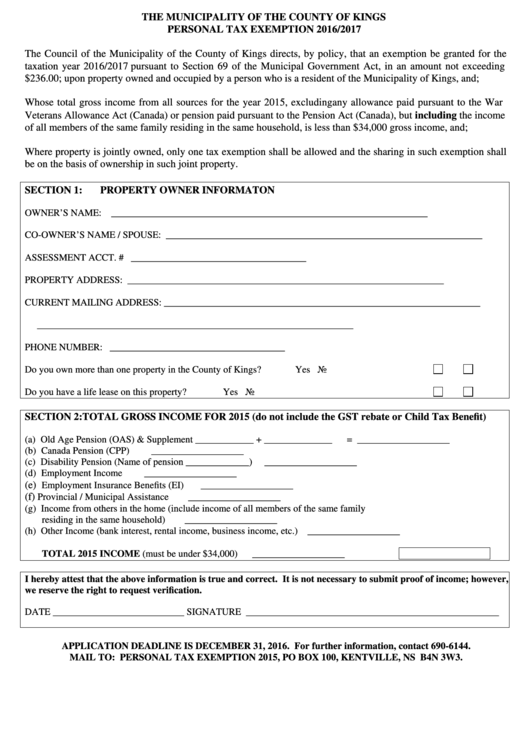

THE MUNICIPALITY OF THE COUNTY OF KINGS

PERSONAL TAX EXEMPTION 2016/2017

The Council of the Municipality of the County of Kings directs, by policy, that an exemption be granted for the

taxation year 2016/2017 pursuant to Section 69 of the Municipal Government Act, in an amount not exceeding

$236.00; upon property owned and occupied by a person who is a resident of the Municipality of Kings, and;

Whose total gross income from all sources for the year 2015, excluding any allowance paid pursuant to the War

Veterans Allowance Act (Canada) or pension paid pursuant to the Pension Act (Canada), but including the income

of all members of the same family residing in the same household, is less than $34,000 gross income, and;

Where property is jointly owned, only one tax exemption shall be allowed and the sharing in such exemption shall

be on the basis of ownership in such joint property.

SECTION 1:

PROPERTY OWNER INFORMATON

OWNER’S NAME:

_________________________________________________________________

CO-OWNER’S NAME / SPOUSE:

_________________________________________________________________

ASSESSMENT ACCT. #

____________________________________

PROPERTY ADDRESS:

_________________________________________________________________

CURRENT MAILING ADDRESS:

_________________________________________________________________

_________________________________________________________________

PHONE NUMBER:

____________________________________

Do you own more than one property in the County of Kings?

Yes

No

Do you have a life lease on this property?

Yes

No

SECTION 2: TOTAL GROSS INCOME FOR 2015 (do not include the GST rebate or Child Tax Benefit)

(a) Old Age Pension (OAS) & Supplement

____________ + ______________

=

___________________

(b) Canada Pension (CPP)

___________________

(c) Disability Pension (Name of pension _____________)

___________________

(d) Employment Income

___________________

(e)

Employment Insurance Benefits (EI)

___________________

(f)

Provincial / Municipal Assistance

___________________

(g) Income from others in the home (include income of all members of the same family

residing in the same household)

___________________

(h) Other Income (bank interest, rental income, business income, etc.)

___________________

TOTAL 2015 INCOME (must be under $34,000)

___________________

I hereby attest that the above information is true and correct. It is not necessary to submit proof of income; however,

we reserve the right to request verification.

DATE ___________________________ SIGNATURE ____________________________________________________

APPLICATION DEADLINE IS DECEMBER 31, 2016. For further information, contact 690-6144.

MAIL TO: PERSONAL TAX EXEMPTION 2015, PO BOX 100, KENTVILLE, NS B4N 3W3.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1