Independent Student Verification Worksheet

ADVERTISEMENT

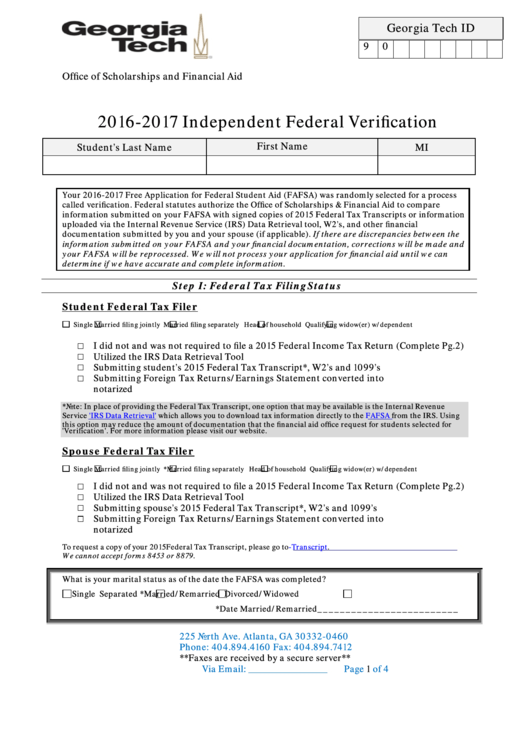

Georgia Tech ID

9

0

Office of Scholarships and Financial Aid

2016-2017 Independent Federal Verification

First Name

Student’s Last Name

MI

Your 2016-2017 Free Application for Federal Student Aid (FAFSA) was randomly selected for a process

called verification. Federal statutes authorize the Office of Scholarships & Financial Aid to compare

information submitted on your FAFSA with signed copies of 2015 Federal Tax Transcripts or information

uploaded via the Internal Revenue Service (IRS) Data Retrieval tool, W2’s, and other financial

documentation submitted by you and your spouse (if applicable). If there are discrepancies between the

information submitted on your FAFSA and your financial documentation, corrections will be made and

your FAFSA will be reprocessed. We will not process your application for financial aid until we can

determine if we have accurate and complete information.

Step I: Federal Tax Filing Status

Student Federal Tax Filer

Single

Married filing jointly

Married filing separately

Head of household

Qualifying widow(er) w/dependent

I did not and was not required to file a 2015 Federal Income Tax Return (Complete Pg.2)

Utilized the IRS Data Retrieval Tool

Submitting student’s 2015 Federal Tax Transcript*, W2’s and 1099’s

Submitting Foreign Tax Returns/Earnings Statement converted into U.S. dollars and

notarized

*Note: In place of providing the Federal Tax Transcript, one option that may be available is the Internal Revenue

Service

'IRS Data Retrieval'

which allows you to download tax information directly to the

FAFSA

from the IRS. Using

this option may reduce the amount of documentation that the financial aid office request for students selected for

'Verification'. For more information please visit our website.

Spouse Federal Tax Filer

Single

Married filing jointly

*Married filing separately

Head of household

Qualifying widow(er) w/dependent

I did not and was not required to file a 2015 Federal Income Tax Return (Complete Pg.2)

Utilized the IRS Data Retrieval Tool

Submitting spouse’s 2015 Federal Tax Transcript*, W2’s and 1099’s

Submitting Foreign Tax Returns/Earnings Statement converted into U.S. dollars and

notarized

To request a copy of your 2015 Federal Tax Transcript, please go to

We cannot accept forms 8453 or 8879.

What is your marital status as of the date the FAFSA was completed?

Single

Separated

*Married/Remarried

Divorced/Widowed

*Date Married/Remarried_________________________

225 North Ave. Atlanta, GA 30332-0460

Phone: 404.894.4160 Fax: 404.894.7412

**Faxes are received by a secure server**

Via Email: finaid@gatech.edu

Page

1

of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4