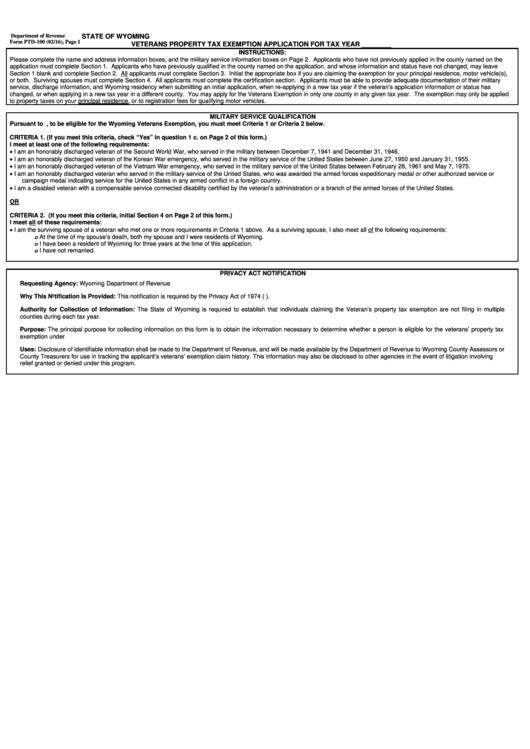

Department of Revenue

STATE OF WYOMING

Form PTD-100 (02/16), Page 1

VETERANS PROPERTY TAX EXEMPTION APPLICATION FOR TAX YEAR ________

INSTRUCTIONS:

Please complete the name and address information boxes, and the military service information boxes on Page 2. Applicants who have not previously applied in the county named on the

application must complete Section 1. Applicants who have previously qualified in the county named on the application, and whose information and status have not changed, may leave

Section 1 blank and complete Section 2. All applicants must complete Section 3. Initial the appropriate box if you are claiming the exemption for your principal residence, motor vehicle(s),

or both. Surviving spouses must complete Section 4. All applicants must complete the certification section. Applicants must be able to provide adequate documentation of their military

service, discharge information, and Wyoming residency when submitting an initial application, when re-applying in a new tax year if the veteran’s application information or status has

changed, or when applying in a new tax year in a different county. You may apply for the Veterans Exemption in only one county in any given tax year. The exemption may only be applied

to property taxes on your principal residence, or to registration fees for qualifying motor vehicles.

MILITARY SERVICE QUALIFICATION

Pursuant to W.S. 39-13-105, to be eligible for the Wyoming Veterans Exemption, you must meet Criteria 1 or Criteria 2 below.

CRITERIA 1. (If you meet this criteria, check “Yes” in question 1 c. on Page 2 of this form.)

I meet at least one of the following requirements:

I am an honorably discharged veteran of the Second World War, who served in the military between December 7, 1941 and December 31, 1946.

I am an honorably discharged veteran of the Korean War emergency, who served in the military service of the United States between June 27, 1950 and January 31, 1955.

I am an honorably discharged veteran of the Vietnam War emergency, who served in the military service of the United States between February 28, 1961 and May 7, 1975.

I am an honorably discharged veteran who served in the military service of the United States, who was awarded the armed forces expeditionary medal or other authorized service or

campaign medal indicating service for the United States in any armed conflict in a foreign country.

I am a disabled veteran with a compensable service connected disability certified by the veteran’s administration or a branch of the armed forces of the United States.

OR

CRITERIA 2. (If you meet this criteria, initial Section 4 on Page 2 of this form.)

I meet all of these requirements:

I am the surviving spouse of a veteran who met one or more requirements in Criteria 1 above. As a surviving spouse, I also meet all of the following requirements:

At the time of my spouse’s death, both my spouse and I were residents of Wyoming.

o

I have been a resident of Wyoming for three years at the time of this application.

o

I have not remarried.

o

PRIVACY ACT NOTIFICATION

Requesting Agency: Wyoming Department of Revenue

Why This Notification Is Provided: This notification is required by the Privacy Act of 1974 (P.L. 93-597).

Authority for Collection of Information: The State of Wyoming is required to establish that individuals claiming the Veteran’s property tax exemption are not filing in multiple

counties during each tax year.

Purpose: The principal purpose for collecting information on this form is to obtain the information necessary to determine whether a person is eligible for the veterans’ property tax

exemption under W.S. 39-13-105.

Uses: Disclosure of identifiable information shall be made to the Department of Revenue, and will be made available by the Department of Revenue to Wyoming County Assessors or

County Treasurers for use in tracking the applicant’s veterans’ exemption claim history. This information may also be disclosed to other agencies in the event of litigation involving

relief granted or denied under this program.

1

1 2

2