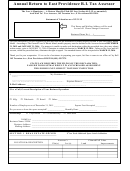

State of California—Health and Human Services Agency

Department of Health Care Services

2d. “Previously submitted business telephone number” if applicable. Enter your new business name in item 2a and your new

business telephone number in 2b if applicable.

3a. “Business address”— Enter the actual business location including the street name and number, room or suite number or

letter, city, county, state, and nine-digit ZIP code.

3b. “Previously submitted business address”— Enter the previous business location if your business has moved. Provide the

new business address in 3a.

4a. “Pay-to address” is the address at which the provider wishes to receive payment. The pay-to address should include, as

applicable, the post office box number, street number and name, room or suite number or letter, city, state, and nine-digit

ZIP code.

4b. “Previously submitted pay-to address” — If you wish to change your pay- to address on file, enter the new pay-to address

in item 4a and your previous pay-to address in item 4b.

5a. “Mailing address” is the location at which the applicant or provider wishes to receive general Medi-Cal correspondence.

5b. “Previously submitted mailing address” — If you wish to change your mailing address on file, enter your previous mailing

address in 5b and your new mailing address in 5a.

6a-6c. Enter each taxonomy code(s) associated with your NPI. Attach additional sheet(s) if needed.

6d. If there has been a change in your primary taxonomy code since your last form was submitted, provide the previously

submitted taxonomy code in item 6d and the new primary taxonomy code in 6a

7a. Enter the Taxpayer Identification Number (TIN). A TIN is an identification number used by the IRS in the administration of

tax laws. Examples of TINs are the following: Employer Identification Number (EIN), Individual Taxpayer Identification

Number (ITIN), Social Security Number (SSN). If you do not have an EIN or an ITIN, then provide your SSN in 7c. If you

are using an EIN, attach a legible copy of the IRS Form 941, Form 8109-C, Letter 147-C, or Form SS-4 (Confirmation

Notification) and provide that number in 7a. If you are using an ITIN, attach a copy of your IRS ITIN notification letter.

7b. If applicable, enter previously submitted TIN issued by the IRS.

7c. If you do not have an EIN or an ITIN, enter your SSN.

8. Enter your provider type. “Provider Type” refers to the type of professional service you provide to beneficiaries. Examples

of provider types include but are not limited to the following: Physician, Chiropractor, Podiatrist, Medical Transportation

Provider, Pharmacy, Psychologist, Speech Therapist, Optometrist.

9a. If you have a professional license, enter your professional license number.

9b. Enter the state of issuance for the professional license.

10. Enter other information you wish to provide to DHCS. If you would like to explain an entry on the form, provide that

explanation in this box.

II. Signature

1. Print name of the provider signing the form.

2. Print name of representative if provider is a business entity.

3. Provide an original signature of the provider or representative. Include the city, state, and the date where and when the

form was signed.

4. To assist in the processing of the Crossover Only Provider Form, enter the name, e-mail address, and telephone number of

the individual who can be contacted by Provider Enrollment staff to answer questions regarding the form. Failure to include

this information may result in a significant delay in the processing your request.

Remember to attach a legible copy of the following, as applicable:

Centers for Medicare and Medicaid (CMS) Approval Letter

TIN (EIN, ITIN verification)

Page 2 of 4

MC 0804 (10/10)

1

1 2

2 3

3 4

4