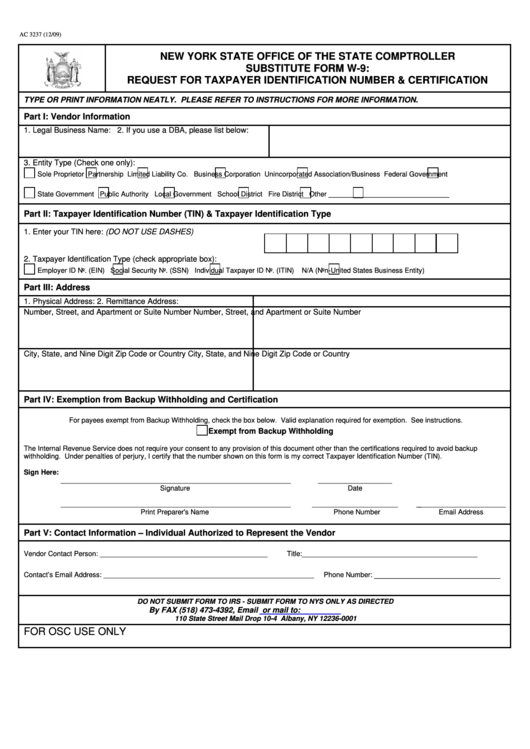

AC 3237 (12/09)

NEW YORK STATE OFFICE OF THE STATE COMPTROLLER

SUBSTITUTE FORM W-9:

REQUEST FOR TAXPAYER IDENTIFICATION NUMBER & CERTIFICATION

TYPE OR PRINT INFORMATION NEATLY. PLEASE REFER TO INSTRUCTIONS FOR MORE INFORMATION.

Part I: Vendor Information

1. Legal Business Name:

2. If you use a DBA, please list below:

3. Entity Type (Check one only):

Sole Proprietor

Partnership

Limited Liability Co.

Business Corporation

Unincorporated Association/Business

Federal Government

State Government

Public Authority

Local Government

School District

Fire District

Other _______________________________

Part II: Taxpayer Identification Number (TIN) & Taxpayer Identification Type

1. Enter your TIN here: (DO NOT USE DASHES)

2. Taxpayer Identification Type (check appropriate box):

Employer ID No. (EIN)

Social Security No. (SSN)

Individual Taxpayer ID No. (ITIN)

N/A (Non-United States Business Entity)

Part III: Address

1. Physical Address:

2. Remittance Address:

Number, Street, and Apartment or Suite Number

Number, Street, and Apartment or Suite Number

City, State, and Nine Digit Zip Code or Country

City, State, and Nine Digit Zip Code or Country

Part IV: Exemption from Backup Withholding and Certification

For payees exempt from Backup Withholding, check the box below. Valid explanation required for exemption. See instructions.

Exempt from Backup Withholding

The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup

withholding. Under penalties of perjury, I certify that the number shown on this form is my correct Taxpayer Identification Number (TIN).

Sign Here:

___________________________________________________________

___________________

Signature

Date

___________________________________________________________

______________________

________________________

Print Preparer's Name

Phone Number

Email Address

Part V: Contact Information – Individual Authorized to Represent the Vendor

Vendor Contact Person: ___________________________________________

Title:_____________________________________________

________________________

Contact’s Email Address: ______________________________________________________

Phone Number:

DO NOT SUBMIT FORM TO IRS - SUBMIT FORM TO NYS ONLY AS DIRECTED

By FAX (518) 473-4392, Email

VMU@osc.state.ny.us

or mail to:

110 State Street Mail Drop 10-4 Albany, NY 12236-0001

FOR OSC USE ONLY

1

1 2

2