Atf Form 56305 - Special Tax Registration And Return (Nyc)

ADVERTISEMENT

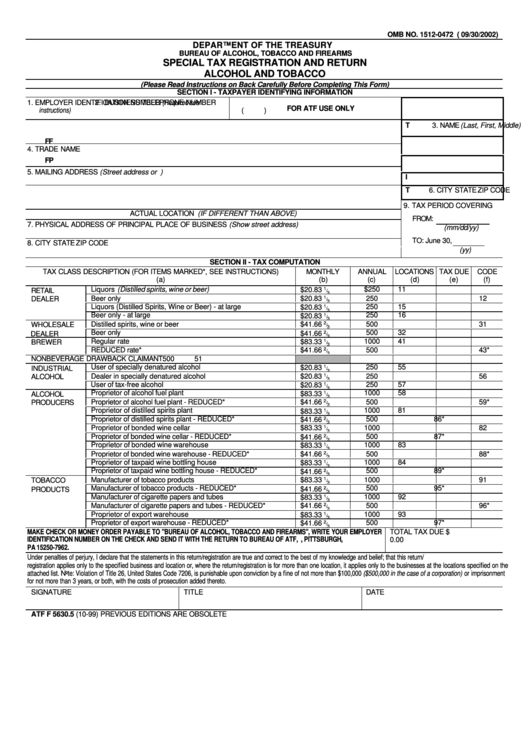

OMB NO. 1512-0472 ( 09/30/2002)

DEPARTMENT OF THE TREASURY

BUREAU OF ALCOHOL, TOBACCO AND FIREARMS

SPECIAL TAX REGISTRATION AND RETURN

ALCOHOL AND TOBACCO

(Please Read Instructions on Back Carefully Before Completing This Form)

SECTION I - TAXPAYER IDENTIFYING INFORMATION

1. EMPLOYER IDENTIFICATION NUMBER (Required see

2. BUSINESS TELEPHONE NUMBER

instructions)

FOR ATF USE ONLY

(

)

3. NAME (Last, First, Middle)

or

CORPORATE NAME (If Corporation)

T

FF

4. TRADE NAME

FP

5. MAILING ADDRESS (Street address or P.O. box number)

I

6. CITY

STATE

ZIP CODE

T

9. TAX PERIOD COVERING

ACTUAL LOCATION (IF DIFFERENT THAN ABOVE)

FROM:

7. PHYSICAL ADDRESS OF PRINCIPAL PLACE OF BUSINESS (Show street address)

(mm/dd/yy)

TO: June 30,

8. CITY

STATE

ZIP CODE

(yy)

SECTION II - TAX COMPUTATION

TAX CLASS DESCRIPTION (FOR ITEMS MARKED*, SEE INSTRUCTIONS)

MONTHLY

ANNUAL

LOCATIONS

TAX DUE

CODE

(a)

(b)

(c)

(d)

(e)

(f)

Liquors (Distilled spirits, wine or beer)

$250

11

$20.83

1 /

RETAIL

3

Beer only

$20.83

1 /

250

12

DEALER

3

Liquors (Distilled Spirits, Wine or Beer) - at large

250

15

$20.83

1 /

3

Beer only - at large

250

16

$20.83

1 /

3

Distilled spirits, wine or beer

$41.66

2 /

500

31

WHOLESALE

3

Beer only

500

32

$41.66

2 /

DEALER

3

Regular rate

1000

41

$83.33

1 /

BREWER

3

REDUCED rate*

$41.66

2 /

500

43*

3

NONBEVERAGE DRAWBACK CLAIMANT

500

51

User of specially denatured alcohol

250

55

$20.83

1 /

INDUSTRIAL

3

1 /

Dealer in specially denatured alcohol

$20.83

250

56

ALCOHOL

3

User of tax-free alcohol

250

57

$20.83

1 /

3

Proprietor of alcohol fuel plant

1000

58

$83.33

1 /

ALCOHOL

3

Proprietor of alcohol fuel plant - REDUCED*

$41.66

2 /

500

59*

PRODUCERS

3

Proprietor of distilled spirits plant

1000

81

$83.33

1 /

3

Proprietor of distilled spirits plant - REDUCED*

500

86*

$41.66

2 /

3

Proprietor of bonded wine cellar

$83.33

1 /

1000

82

3

Proprietor of bonded wine cellar - REDUCED*

500

87*

$41.66

2 /

3

Proprietor of bonded wine warehouse

1000

83

$83.33

1 /

3

Proprietor of bonded wine warehouse - REDUCED*

$41.66

2 /

500

88*

3

Proprietor of taxpaid wine bottling house

1000

84

$83.33

1 /

3

Proprietor of taxpaid wine bottling house - REDUCED*

500

89*

2 /

$41.66

3

Manufacturer of tobacco products

$83.33

1 /

1000

91

TOBACCO

3

Manufacturer of tobacco products - REDUCED*

500

95*

$41.66

2 /

PRODUCTS

3

Manufacturer of cigarette papers and tubes

1000

92

$83.33

1 /

3

2 /

Manufacturer of cigarette papers and tubes - REDUCED*

$41.66

500

96*

3

Proprietor of export warehouse

1000

93

$83.33

1 /

3

Proprietor of export warehouse - REDUCED*

500

97*

$41.66

2 /

3

MAKE CHECK OR MONEY ORDER PAYABLE TO "BUREAU OF ALCOHOL, TOBACCO AND FIREARMS", WRITE YOUR EMPLOYER

TOTAL TAX DUE $

IDENTIFICATION NUMBER ON THE CHECK AND SEND IT WITH THE RETURN TO BUREAU OF ATF, P.O. BOX 371962, PITTSBURGH,

0.00

PA 15250-7962.

Under penalties of perjury, I declare that the statements in this return/registration are true and correct to the best of my knowledge and belief; that this return/

registration applies only to the specified business and location or, where the return/registration is for more than one location, it applies only to the businesses at the locations specified on the

attached list. Note: Violation of Title 26, United States Code 7206, is punishable upon conviction by a fine of not more than $100,000 ($500,000 in the case of a corporation) or imprisonment

for not more than 3 years, or both, with the costs of prosecution added thereto.

SIGNATURE

TITLE

DATE

ATF F 5630.5 (10-99) PREVIOUS EDITIONS ARE OBSOLETE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4