Reset This Form

OFFICE USE ONLY

TRN

Period/Year

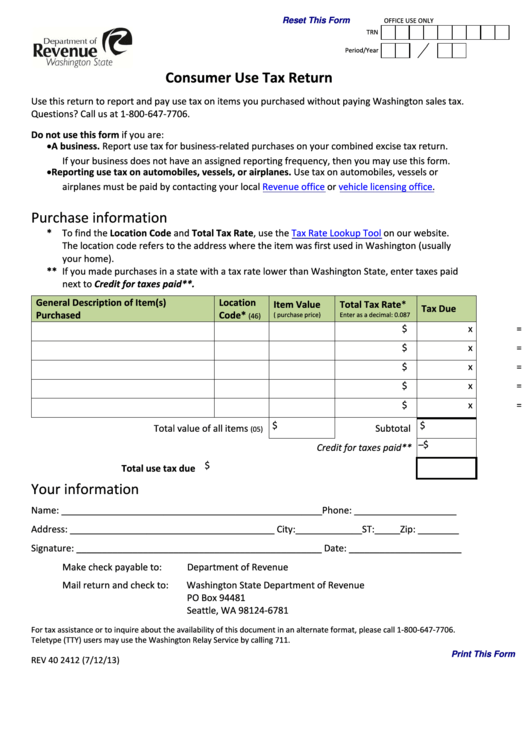

Consumer Use Tax Return

Use this return to report and pay use tax on items you purchased without paying Washington sales tax.

Questions? Call us at 1‐800‐647‐7706.

Do not use this form if you are:

A business. Report use tax for business‐related purchases on your combined excise tax return.

If your business does not have an assigned reporting frequency, then you may use this form.

Reporting use tax on automobiles, vessels, or airplanes. Use tax on automobiles, vessels or

airplanes must be paid by contacting your local Revenue office or vehicle licensing office.

Purchase information

* To find the Location Code and Total Tax Rate, use the Tax Rate Lookup Tool on our website.

The location code refers to the address where the item was first used in Washington (usually

your home).

** If you made purchases in a state with a tax rate lower than Washington State, enter taxes paid

next to Credit for taxes paid**.

General Description of Item(s)

Location

Item Value

Total Tax Rate*

Tax Due

Purchased

Code*

(i.e. purchase price)

Enter as a decimal: 0.087

(46)

$

x =

$

$

x =

$

$

x =

$

$

x =

$

$

x =

$

$

Subtotal $

Total value of all items

(05)

Credit for taxes paid** ̶ ̶ $

Total use tax due $

Your information

Name: ___________________________________________________Phone: ____________________

Address: ________________________________________ City:_____________ST:_____Zip: ________

Signature: ________________________________________________ Date: ______________________

Make check payable to: Department of Revenue

Mail return and check to:

Washington State Department of Revenue

PO Box 94481

Seattle, WA 98124‐6781

For tax assistance or to inquire about the availability of this document in an alternate format, please call 1‐800‐647‐7706.

Teletype (TTY) users may use the Washington Relay Service by calling 711.

Print This Form

REV 40 2412 (7/12/13)

1

1