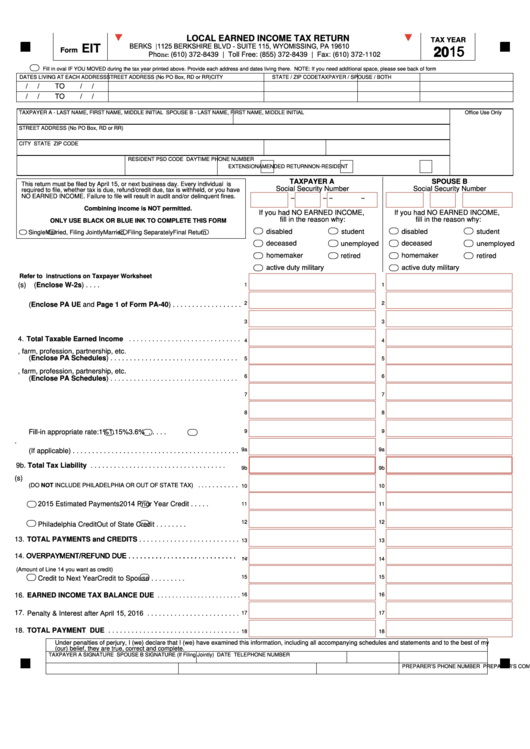

LOCAL EARNED INCOME TAX RETURN

TAX YEAR

EIT

BERKS E.I.T. BUREAU | 1125 BERKSHIRE BLVD - SUITE 115, WYOMISSING, PA 19610

20 15

Form

Phone: (610) 372-8439 | Toll Free: (855) 372-8439 | Fax: (610) 372-1102

Fill in oval IF YOU MOVED during the tax year printed above. Provide each address and dates living there. NOTE: If you need additional space, please see back of form

DATES LIVING AT EACH ADDRESS

STREET ADDRESS (No PO Box, RD or RR)

CITY

STATE / ZIP CODE

TAXPAYER / SPOUSE / BOTH

/

/

TO

/

/

/

/

TO

/

/

TAXPAYER A - LAST NAME, FIRST NAME, MIDDLE INITIAL

SPOUSE B - LAST NAME, FIRST NAME, MIDDLE INITIAL

Office Use Only

STREET ADDRESS (No PO Box, RD or RR)

CITY

STATE

ZIP CODE

DAYTIME PHONE NUMBER

RESIDENT PSD CODE

EXTENSION

AMENDED RETURN

NON-RESIDENT

TAXPAYER A

SPOUSE B

This return must be filed by April 15, or next business day. Every individual is

Social Security Number

Social Security Number

required to file, whether tax is due, refund/credit due, tax is withheld, or you have

NO EARNED INCOME. Failure to file will result in audit and/or delinquent fines.

-

-

-

-

Combining income is NOT permitted.

If you had NO EARNED INCOME,

If you had NO EARNED INCOME,

fill in the reason why:

fill in the reason why:

ONLY USE BLACK OR BLUE INK TO COMPLETE THIS FORM

disabled

student

disabled

student

Single

Married, Filing Jointly

Married, Filing Separately

Final Return

deceased

unemployed

deceased

unemployed

homemaker

homemaker

retired

retired

active duty military

active duty military

Refer to instructions on Taxpayer Worksheet

1. Gross Compensation as Reported on W-2(s)

(Enclose W-2s) . . . .

1

1

2. Unreimbursed Employee Business Expenses

(Enclose PA UE and Page 1 of Form PA-40) . . . . . . . . . . . . . . . . . .

2

2

3. Other Taxable Earned Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3

4. Total Taxable Earned Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4

5. Net Profit from a business, farm, profession, partnership, etc.

(Enclose PA Schedules) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5

6. Net Loss from a business, farm, profession, partnership, etc.

6

6

(Enclose PA Schedules) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Total Taxable Net Profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7

8. Total Taxable Earned Income and Net Profit . . . . . . . . . . . . . . . . . . .

8

8

9. Total Resident Local Income Tax

Fill-in appropriate rate:

1%

1.15%

3.6% . . . . .

9

9

. 9a. City of Reading Distressed Commuter Tax

(If applicable) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9a

9a

9b. Total Tax Liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9b

9b

10. Total Local Earned Income Tax Withheld as Reported on W-2(s)

. . . . . . . .

(DO NOT INCLUDE PHILADELPHIA OR OUT OF STATE TAX) . . .

10

10

11. Quarterly Estimated Payments/Credit from Previous Tax Year

Estimated Payments

Prior Year Credit . . . . .

11

11

12. Miscellaneous Tax Credits

12

12

Philadelphia Credit

Out of State Credit . . . . . . . .

13. TOTAL PAYMENTS and CREDITS . . . . . . . . . . . . . . . . . . . . . . . . . .

13

13

14.

. .

14

14

15. Credit to Taxpayer/Spouse

(Amount of Line 14 you want as credit)

15

15

Credit to Next Year

Credit to Spouse . . . . . . . . .

16. EARNED INCOME TAX BALANCE DUE

. . . . . . . . . . . . . . . . . . . . . . .

16

16

17. Penalty & Interest after April 15, 2016 . . . . . . . . . . . . . . . . . . . . . .

17

17

18. TOTAL PAYMENT DUE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

18

Under penalties of perjury, I (we) declare that I (we) have examined this information, including all accompanying schedules and statements and to the best of my

(our) belief, they are true, correct and complete.

TAXPAYER A SIGNATURE

SPOUSE B SIGNATURE (If Filing Jointly)

DATE

TELEPHONE NUMBER

TAXPAYER E-MAIL ADDRESS

PREPARER’S NAME

PREPARER’S COMPANY

PREPARER’S PHONE NUMBER

1

1 2

2 3

3