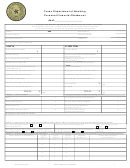

Round all amounts to the nearest $100. Please contact your banker if you need assistance completing the schedules.

Schedule 1

Cash, Savings, Certificates of Deposit, and Money Market Accounts

Name of Bank or Financial Institution

Type of Account

Acct. Balance

(use attachments if necessary)

Total $

0

Schedule 2

Stocks, Bonds, or Other Securities Owned

# of shares or

Type of account

Name on account

Current market

bonds

value

Listed

Unlisted

Listed

Unlisted

Listed

Unlisted

Listed

Unlisted

Listed

Unlisted

Listed

Unlisted

Listed

Unlisted

(use attachments if necessary)

Total $

0

Schedule 3

Retirement, 401K, Profit Sharing, Pension, IRA Accounts, Keogh

Name of Institution

Account Type

Amount Vested %

Account Balance

Loans

(use attachments if necessary)

Totals $

0

0

Schedule 4

Cash Value of Life Insurance (whole life only)

Insurance Company

Name Insured

Beneficiary

Face Value

Cash Value

Loans

Totals $

0

0

Schedule 5

Real Estate / Mortgages / Contract for deeds / Contracts Owned

Monthly

Purchase

Mortgage

Monthly

Rental

Maturity

Personal residence (homestead)

Lender/Creditor

Market Value

Property Address

Year

Price

Balance

Payment

Income

Date

Monthly

Other Real Estate (rental homes,

Purchase

Mortgage

Monthly

Rental

Maturity

cabin, vacation homes, etc.)

Lender/Creditor

Market Value

Property Address

Year

Price

Balance

Payment

Income

Date

Totals $

0

0

(use attachments if more space is needed)

Monthly

Commercial Real Estate,

Purchase

Mortgage

Monthly

Rental

Maturity

Investment Real Estate, Etc.

Lender/Creditor

Market Value

Property Address

Year

Price

Balance

Payment

Income

Date

(Indicate if property is sold on contract for deed by

Totals $

0

0

marking “C4D” next to the property address)

1

1 2

2 3

3 4

4