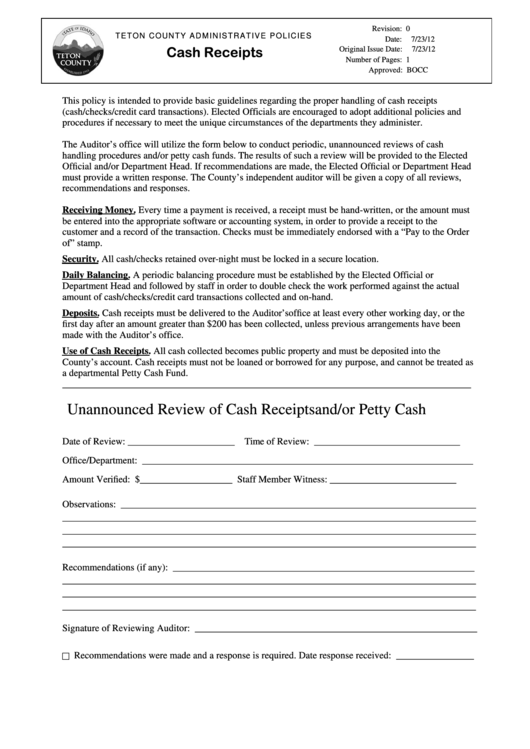

Unannounced Review Of Cash Receipts And Or Petty Cash

ADVERTISEMENT

Revision:

0

T E TO N C O U N T Y A D M I N I S TR A TI V E P O L I C I E S

Date:

7/23/12

Cash Receipts

Original Issue Date:

7/23/12

Number of Pages:

1

Approved:

BOCC

This policy is intended to provide basic guidelines regarding the proper handling of cash receipts

(cash/checks/credit card transactions). Elected Officials are encouraged to adopt additional policies and

procedures if necessary to meet the unique circumstances of the departments they administer.

The Auditor’s office will utilize the form below to conduct periodic, unannounced reviews of cash

handling procedures and/or petty cash funds. The results of such a review will be provided to the Elected

Official and/or Department Head. If recommendations are made, the Elected Official or Department Head

must provide a written response. The County’s independent auditor will be given a copy of all reviews,

recommendations and responses.

Receiving Money. Every time a payment is received, a receipt must be hand-written, or the amount must

be entered into the appropriate software or accounting system, in order to provide a receipt to the

customer and a record of the transaction. Checks must be immediately endorsed with a “Pay to the Order

of” stamp.

Security. All cash/checks retained over-night must be locked in a secure location.

Daily Balancing. A periodic balancing procedure must be established by the Elected Official or

Department Head and followed by staff in order to double check the work performed against the actual

amount of cash/checks/credit card transactions collected and on-hand.

Deposits. Cash receipts must be delivered to the Auditor’s office at least every other working day, or the

first day after an amount greater than $200 has been collected, unless previous arrangements have been

made with the Auditor’s office.

Use of Cash Receipts. All cash collected becomes public property and must be deposited into the

County’s account. Cash receipts must not be loaned or borrowed for any purpose, and cannot be treated as

a departmental Petty Cash Fund.

____________________________________________________________________________________

Unannounced Review of Cash Receipts and/or Petty Cash

Date of Review: ______________________

Time of Review: ______________________________

Office/Department: ____________________________________________________________________

Amount Verified: $___________________

Staff Member Witness: __________________________

Observations: _________________________________________________________________________

_____________________________________________________________________________________

_____________________________________________________________________________________

_____________________________________________________________________________________

Recommendations (if any): ______________________________________________________________

_____________________________________________________________________________________

_____________________________________________________________________________________

_____________________________________________________________________________________

Signature of Reviewing Auditor: __________________________________________________________

Recommendations were made and a response is required. Date response received: ________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1