Verification Worksheet

ADVERTISEMENT

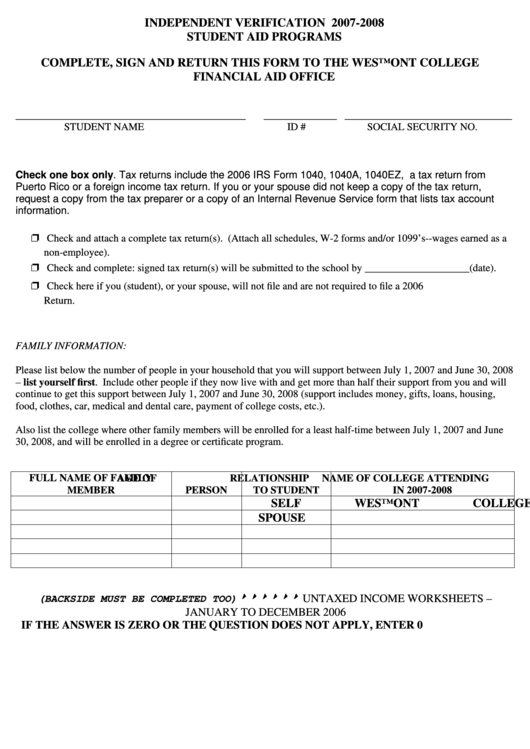

INDEPENDENT VERIFICATION 2007-2008

STUDENT AID PROGRAMS

COMPLETE, SIGN AND RETURN THIS FORM TO THE WESTMONT COLLEGE

FINANCIAL AID OFFICE

____________________________________________

______________ ________________________________

STUDENT NAME

ID #

SOCIAL SECURITY NO.

Check one box only. Tax returns include the 2006 IRS Form 1040, 1040A, 1040EZ, a tax return from

Puerto Rico or a foreign income tax return. If you or your spouse did not keep a copy of the tax return,

request a copy from the tax preparer or a copy of an Internal Revenue Service form that lists tax account

information.

❐ Check and attach a complete tax return(s). (Attach all schedules, W-2 forms and/or 1099’s--wages earned as a

non-employee).

❐ Check and complete: signed tax return(s) will be submitted to the school by ____________________(date).

❐ Check here if you (student), or your spouse, will not file and are not required to file a 2006 U.S. Income Tax

Return.

FAMILY INFORMATION:

Please list below the number of people in your household that you will support between July 1, 2007 and June 30, 2008

– list yourself first. Include other people if they now live with and get more than half their support from you and will

continue to get this support between July 1, 2007 and June 30, 2008 (support includes money, gifts, loans, housing,

food, clothes, car, medical and dental care, payment of college costs, etc.).

Also list the college where other family members will be enrolled for a least half-time between July 1, 2007 and June

30, 2008, and will be enrolled in a degree or certificate program.

FULL NAME OF FAMILY

AGE OF

RELATIONSHIP

NAME OF COLLEGE ATTENDING

MEMBER

PERSON

TO STUDENT

IN 2007-2008

SELF

WESTMONT COLLEGE

SPOUSE

888888 UNTAXED INCOME WORKSHEETS –

(BACKSIDE MUST BE COMPLETED TOO)

JANUARY TO DECEMBER 2006

IF THE ANSWER IS ZERO OR THE QUESTION DOES NOT APPLY, ENTER 0

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2