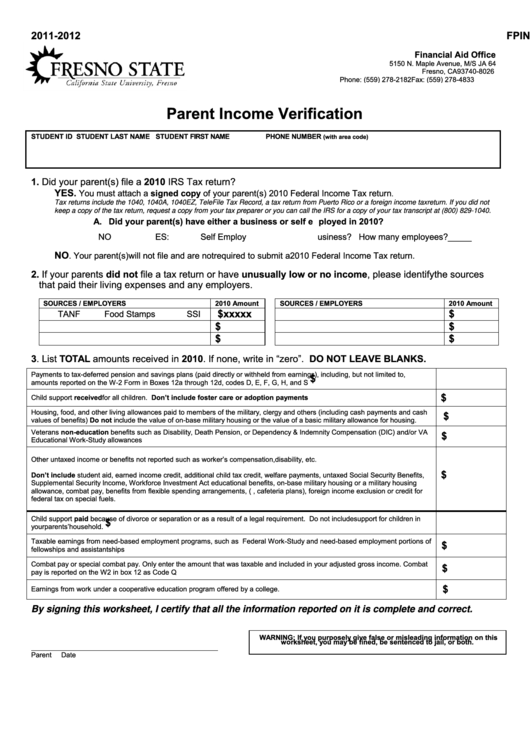

2011-2012

FPINOY

Financial Aid Office

5150 N. Maple Avenue, M/S JA 64

Fresno, CA 93740-8026

Phone: (559) 278-2182

Fax: (559) 278-4833

Parent Income Verification

STUDENT ID

STUDENT LAST NAME

STUDENT FIRST NAME

PHONE NUMBER

(with area code)

1. Did your parent(s) file a 2010 IRS Tax return?

YES.

You must attach a signed copy of your parent(s) 2010 Federal Income Tax return

.

Tax returns include the 1040, 1040A, 1040EZ, TeleFile Tax Record, a tax return from Puerto Rico or a foreign income tax return. If you did not

keep a copy of the tax return, request a copy from your tax preparer or you can call the IRS for a copy of your tax transcript at (800) 829-1040.

A. Did your parent(s) have either a business or self e ployed in 2010?

NO

ES:

Self Employ

usiness?

How many employees? _____

NO

. Your parent(s) will not file and are not required to submit a 2010 Federal Income Tax return.

2. If your parents did not file a tax return or have unusually low or no income, please identify the sources

that paid their living expenses and any employers.

SOURCES / EMPLOYERS

2010 Amount

SOURCES / EMPLOYERS

2010 Amount

$ xxxxx

$

TANF

Food Stamps

SSI

$

$

$

$

3. List TOTAL amounts received in 2010. If none, write in “zero”. DO NOT LEAVE BLANKS.

Payments to tax-deferred pension and savings plans (paid directly or withheld from earnings), including, but not limited to,

$

amounts reported on the W-2 Form in Boxes 12a through 12d, codes D, E, F, G, H, and S

$

Child support received for all children. Don’t include foster care or adoption payments

Housing, food, and other living allowances paid to members of the military, clergy and others (including cash payments and cash

$

values of benefits) Do not include the value of on-base military housing or the value of a basic military allowance for housing.

Veterans non-education benefits such as Disability, Death Pension, or Dependency & Indemnity Compensation (DIC) and/or VA

$

Educational Work-Study allowances

Other untaxed income or benefits not reported such as worker’s compensation, disability, etc.

$

Don’t include student aid, earned income credit, additional child tax credit, welfare payments, untaxed Social Security Benefits,

Supplemental Security Income, Workforce Investment Act educational benefits, on-base military housing or a military housing

allowance, combat pay, benefits from flexible spending arrangements, (e.g., cafeteria plans), foreign income exclusion or credit for

federal tax on special fuels.

Child support paid because of divorce or separation or as a result of a legal requirement. Do not include support for children in

$

your parents’ household.

Taxable earnings from need-based employment programs, such as Federal Work-Study and need-based employment portions of

$

fellowships and assistantships

Combat pay or special combat pay. Only enter the amount that was taxable and included in your adjusted gross income. Combat

$

pay is reported on the W2 in box 12 as Code Q

$

Earnings from work under a cooperative education program offered by a college.

By signing this worksheet, I certify that all the information reported on it is complete and correct.

WARNING: If you purposely give false or misleading information on this

worksheet, you may be fined, be sentenced to jail, or both.

Parent

Date

1

1