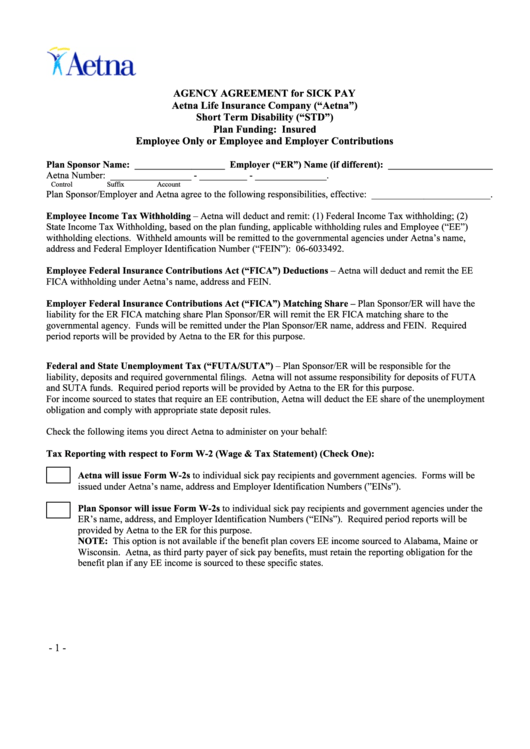

AGENCY AGREEMENT for SICK PAY

Aetna Life Insurance Company (“Aetna”)

Short Term Disability (“STD”)

Plan Funding: Insured

Employee Only or Employee and Employer Contributions

Plan Sponsor Name: ___________________ Employer (“ER”) Name (if different): ______________________

Aetna Number: _________________ - __________ - _______________.

Control

Suffix

Account

Plan Sponsor/Employer and Aetna agree to the following responsibilities, effective: _________________________.

Employee Income Tax Withholding – Aetna will deduct and remit: (1) Federal Income Tax withholding; (2)

State Income Tax Withholding, based on the plan funding, applicable withholding rules and Employee (“EE”)

withholding elections. Withheld amounts will be remitted to the governmental agencies under Aetna’s name,

address and Federal Employer Identification Number (“FEIN”): 06-6033492.

Employee Federal Insurance Contributions Act (“FICA”) Deductions – Aetna will deduct and remit the EE

FICA withholding under Aetna’s name, address and FEIN.

Employer Federal Insurance Contributions Act (“FICA”) Matching Share – Plan Sponsor/ER will have the

liability for the ER FICA matching share Plan Sponsor/ER will remit the ER FICA matching share to the

governmental agency. Funds will be remitted under the Plan Sponsor/ER name, address and FEIN. Required

period reports will be provided by Aetna to the ER for this purpose.

Federal and State Unemployment Tax (“FUTA/SUTA”) – Plan Sponsor/ER will be responsible for the

liability, deposits and required governmental filings. Aetna will not assume responsibility for deposits of FUTA

and SUTA funds. Required period reports will be provided by Aetna to the ER for this purpose.

For income sourced to states that require an EE contribution, Aetna will deduct the EE share of the unemployment

obligation and comply with appropriate state deposit rules.

Check the following items you direct Aetna to administer on your behalf:

Tax Reporting with respect to Form W-2 (Wage & Tax Statement) (Check One):

Aetna will issue Form W-2s to individual sick pay recipients and government agencies. Forms will be

issued under Aetna’s name, address and Employer Identification Numbers (”EINs”).

Plan Sponsor will issue Form W-2s to individual sick pay recipients and government agencies under the

ER’s name, address, and Employer Identification Numbers (“EINs”). Required period reports will be

provided by Aetna to the ER for this purpose.

NOTE: This option is not available if the benefit plan covers EE income sourced to Alabama, Maine or

Wisconsin. Aetna, as third party payer of sick pay benefits, must retain the reporting obligation for the

benefit plan if any EE income is sourced to these specific states.

- 1 -

1

1 2

2