Certification Of Oregon "Use Fuel" Tax Exempt Status

ADVERTISEMENT

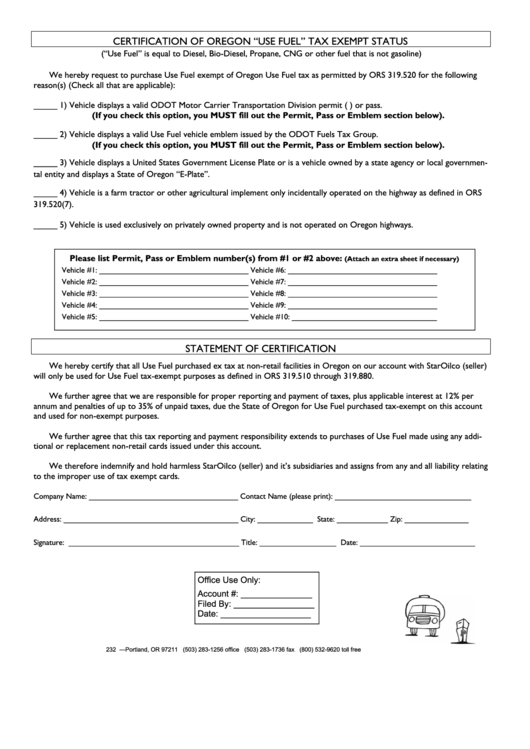

CERTIFICATION OF OREGON “USE FUEL” TAX EXEMPT STATUS

(“Use Fuel” is equal to Diesel, Bio-Diesel, Propane, CNG or other fuel that is not gasoline)

We hereby request to purchase Use Fuel exempt of Oregon Use Fuel tax as permitted by ORS 319.520 for the following

reason(s) (Check all that are applicable):

_____ 1) Vehicle displays a valid ODOT Motor Carrier Transportation Division permit (P.U.C. permit) or pass.

(If you check this option, you MUST fill out the Permit, Pass or Emblem section below).

_____ 2) Vehicle displays a valid Use Fuel vehicle emblem issued by the ODOT Fuels Tax Group.

(If you check this option, you MUST fill out the Permit, Pass or Emblem section below).

_____ 3) Vehicle displays a United States Government License Plate or is a vehicle owned by a state agency or local governmen-

tal entity and displays a State of Oregon “E-Plate”.

_____ 4) Vehicle is a farm tractor or other agricultural implement only incidentally operated on the highway as defined in ORS

319.520(7).

_____ 5) Vehicle is used exclusively on privately owned property and is not operated on Oregon highways.

Please list Permit, Pass or Emblem number(s) from #1 or #2 above:

(Attach an extra sheet if necessary)

Vehicle #1: ___________________________________

Vehicle #6: ___________________________________

Vehicle #2: ___________________________________

Vehicle #7: ___________________________________

Vehicle #3: ___________________________________

Vehicle #8: ___________________________________

Vehicle #4: ___________________________________

Vehicle #9: ___________________________________

Vehicle #5: ___________________________________

Vehicle #10: __________________________________

STATEMENT OF CERTIFICATION

We hereby certify that all Use Fuel purchased ex tax at non-retail facilities in Oregon on our account with StarOilco (seller)

will only be used for Use Fuel tax-exempt purposes as defined in ORS 319.510 through 319.880.

We further agree that we are responsible for proper reporting and payment of taxes, plus applicable interest at 12% per

annum and penalties of up to 35% of unpaid taxes, due the State of Oregon for Use Fuel purchased tax-exempt on this account

and used for non-exempt purposes.

We further agree that this tax reporting and payment responsibility extends to purchases of Use Fuel made using any addi-

tional or replacement non-retail cards issued under this account.

We therefore indemnify and hold harmless StarOilco (seller) and it’s subsidiaries and assigns from any and all liability relating

to the improper use of tax exempt cards.

Company Name: ___________________________________

Contact Name (please print): ________________________________

Address: _________________________________________

City: _____________ State: ____________ Zip: _______________

Signature: ________________________________________

Title: __________________ Date: ___________________________

Office Use Only:

Account #: _______________

Filed By: _________________

Date: ___________________

232 N.E. Middlefield Road—Portland, OR 97211 (503) 283-1256 office (503) 283-1736 fax (800) 532-9620 toll free

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1