Irs / Co Form 8233

ADVERTISEMENT

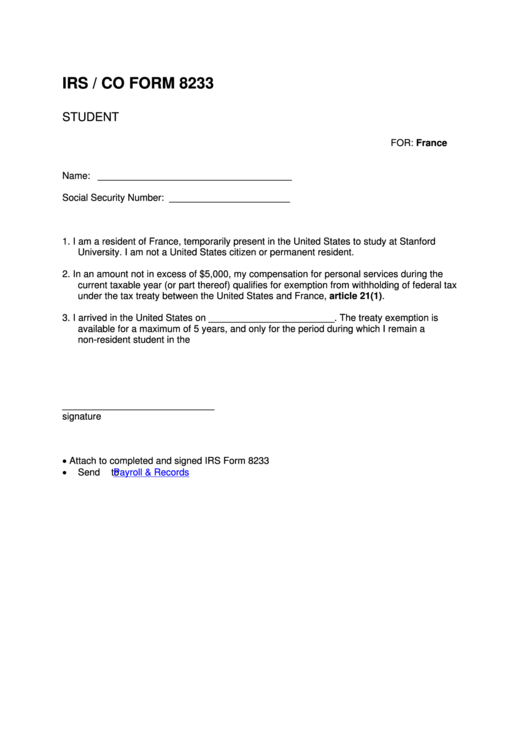

IRS / CO FORM 8233

STUDENT

FOR: France

Name: _____________________________________

Social Security Number: _______________________

1. I am a resident of France, temporarily present in the United States to study at Stanford

University. I am not a United States citizen or permanent resident.

2. In an amount not in excess of $5,000, my compensation for personal services during the

current taxable year (or part thereof) qualifies for exemption from withholding of federal tax

under the tax treaty between the United States and France, article 21(1).

3. I arrived in the United States on ________________________. The treaty exemption is

available for a maximum of 5 years, and only for the period during which I remain a

non-resident student in the U.S.

_____________________________

signature

•

Attach to completed and signed IRS Form 8233

•

Send to

Payroll & Records

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1