School Tax Credit Loan Form

Download a blank fillable School Tax Credit Loan Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete School Tax Credit Loan Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Yuma Central: 1780 S. 1st Avenue

Albertsons: 2378 W. 24th Street

Foothills: 11252 N. Frontage Rd.

Somerton: 530 E. Main Street

Parker: 916 W. 14th St.

| 928.783.8881

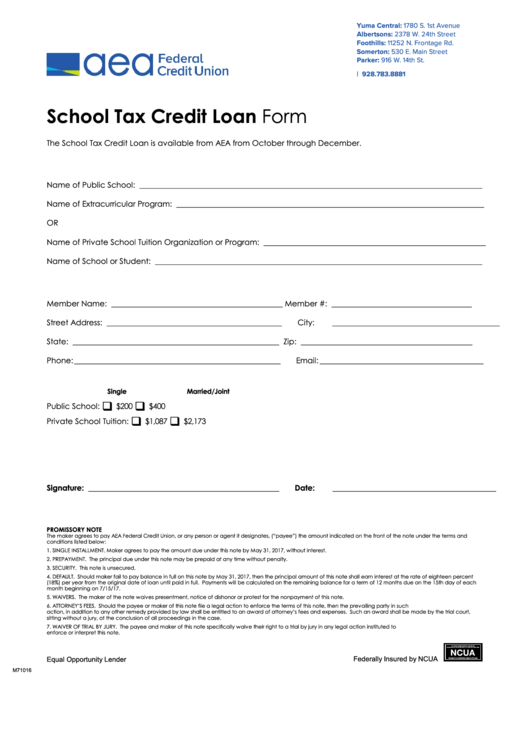

School Tax Credit Loan Form

The School Tax Credit Loan is available from AEA from October through December.

Name of Public School: ________________________________________________________________________________________

Name of Extracurricular Program: _______________________________________________________________________________

OR

Name of Private School Tuition Organization or Program: _________________________________________________________

Name of School or Student: ____________________________________________________________________________________

Member Name: ____________________________________________

Member #: ____________________________________

Street Address: _____________________________________________

City: ___________________________________________

State: _____________________________________________________

Zip: ____________________________________________

Phone: _____________________________________________________

Email: __________________________________________

Single

Married/Joint

q

q

Public School:

$200

$400

q

q

Private School Tuition:

$1,087

$2,173

Signature: _________________________________________________

Date: __________________________________________

PROMISSORY NOTE

The maker agrees to pay AEA Federal Credit Union, or any person or agent it designates, (“payee”) the amount indicated on the front of the note under the terms and

conditions listed below:

1. SINGLE INSTALLMENT. Maker agrees to pay the amount due under this note by May 31, 2017, without interest.

2. PREPAYMENT. The principal due under this note may be prepaid at any time without penalty.

3. SECURITY. This note is unsecured.

4. DEFAULT. Should maker fail to pay balance in full on this note by May 31, 2017, then the principal amount of this note shall earn interest at the rate of eighteen percent

(18%) per year from the original date of loan until paid in full. Payments will be calculated on the remaining balance for a term of 12 months due on the 15th day of each

month beginning on 7/15/17.

5. WAIVERS. The maker of the note waives presentment, notice of dishonor or protest for the nonpayment of this note.

6. ATTORNEY’S FEES. Should the payee or maker of this note file a legal action to enforce the terms of this note, then the prevailing party in such

action, in addition to any other remedy provided by law shall be entitled to an award of attorney’s fees and expenses. Such an award shall be made by the trial court,

sitting without a jury, at the conclusion of all proceedings in the case.

7. WAIVER OF TRIAL BY JURY. The payee and maker of this note specifically waive their right to a trial by jury in any legal action instituted to

enforce or interpret this note.

Federally Insured by NCUA

Equal Opportunity Lender

M71016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1