Sample Form Of Counter-Notification To Mls Property Information Network, Inc. Objecting To A Claim Of Infringement Of Copyright And The Disabling Or Removal Of Material From The Multiple Listing Service Page 3

ADVERTISEMENT

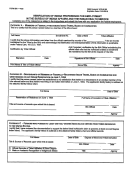

U.S. Department of Housing

Direct Endorsement Approval for a HUD/FHA - Insured Mortgage

and Urban Development

Part I - Identifying Information (mark the type of application)

2. Agency Case No. (include

3. Lender's Case No.

4. Section of the Act

any suffix)

(for HUD cases)

HUD/FHA Application for Insurance

1.

under the National Housing Act

5. Borrower's Name & Present Address (include zip code)

7. Loan Amount (include the UFMIP)

8. Interest Rate

9. Proposed Maturity:

$

%

yrs.

mos.

10. Discount Amt.

11. Amount of Up

12a. Amount of

12b. Term of Annual

(only if borrower is

Front Premium

Annual Premium

Premium

permitted to pay)

6. Property Address: (including name of subdivision, lot & block no. & zip code)

$

$

/mo.

months

13. Lender's I.D. Code

14. Sponsor/Agent I.D. Code

15. Lender's Name & Address: (include zip code)

16. Name & Address of Sponsor/Agent

17. Lender's Telephone Number

Type or Print all entries clearly

Name of Loan Origination Company

Tax ID of Loan Origination Company

NMLS ID of Loan Origination Company

Sponsored

Originations

Approved subject to the additional conditions stated below, if any.

Approved:

Date Mortgage Approved

Date Approval Expires

Term of Annual

Loan Amount(include UFMIP)

Interest Rate

Proposed Maturity

Monthly Pymt.

Amount of Up

Amount of Annual

Modified &

Premium:

Front Premium

Premium

Approved as

follows:

months

$

%

yrs.

mos.

$

$

$

Additional Conditions:

If this is proposed construction, the builder has certified compliance with HUD requirements on form HUD-92541.

If this is new construction, the lender certifies that the property is 100% complete (both on site and off site improvements) and the

property meets HUD's Minimum property standards and local building codes.

Form HUD- 92544, Builders Warranty is required.

The property has a 10-year warranty.

Owner-Occupancy Not required ( item (b) of the Borrower's Certification does not apply).

The mortgage is a high loan-to-value ratio for non-occupant mortgagor in military.

Other: (specify)

This mortgage was rated as an "accept" or "approve" by FHA's Total Mortgage Scorecard. As such, the undersigned representative

of the mortgagee certifies to the integrity of the data supplied by the lender used to determine the quality of the loan, that the Direct

Endorsement Underwriter reviewed the appraisal (if applicable) and further certifies that this mortgage is eligible for HUD mortgage

insurance under the Direct Endorsement program. I hereby make all certifications required for this mortgage as set forth in HUD

Handbook 4000.4.

Mortgagee Representative:

This mortgage was rated as a "refer" by FHA's Total Mortgage Scorecard, and/or was manually underwritten by a Direct Endorsement

underwriter. As such, the undersigned Direct Endorsement underwriter certifies that I have personally reviewed the appraisal report (if

applicable), credit application, and all associated documents and have used due diligence in underwriting this mortgage. I find a that

this mortgage is eligible for HUD mortgage insurance under the Direct Endorsement Program and I hereby make all certifications

required for the mortgage as set forth in HUD handbook 4000.04

Direct Endorsement Underwriter:

DE's CHUMS ID Number:

The Mortgagee, its owners, officers or directors

do

do not have a financial interest in or a relationship,

by affiliation or ownership, with the builder or seller involved in this transaction.

form HUD-92900-A (09/2010)

GCC - 92900A3

(09/2010)

page 3

VA Form 26-1802a

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4