Reset

Print

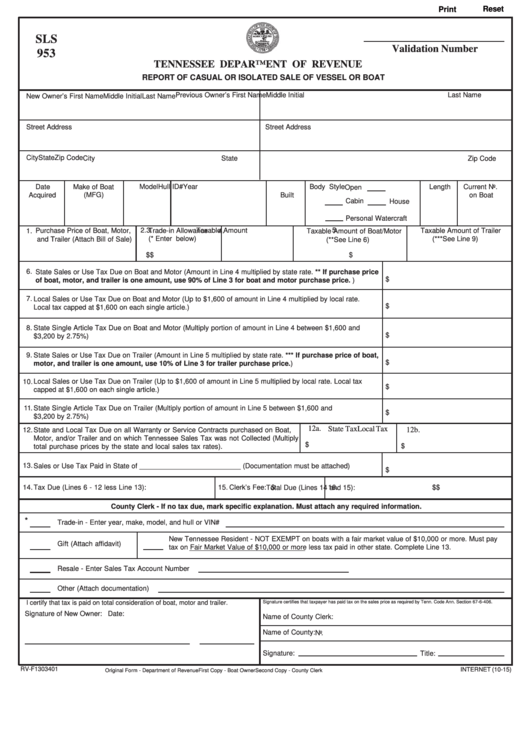

SLS

Validation Number

953

TENNESSEE DEPARTMENT OF REVENUE

REPORT OF CASUAL OR ISOLATED SALE OF VESSEL OR BOAT

Previous Owner’s First Name

Middle Initial

Last Name

New Owner’s First Name

Middle Initial

Last Name

Street Address

Street Address

City

State

Zip Code

City

State

Zip Code

Date

Model

Hull ID#

Year

Body Style

Length

Current No.

Make of Boat

Open

Acquired

(MFG)

Built

on Boat

Cabin

House

Personal Watercraft

Purchase Price of Boat, Motor,

2.

Trade-in Allowance

3.

Taxable Amount

5.

Taxable Amount of Trailer

1.

4.

Taxable Amount of Boat/Motor

(* Enter below)

and Trailer (Attach Bill of Sale)

(***See Line 9)

(**See Line 6)

$

$

$

$

$

6.

State Sales or Use Tax Due on Boat and Motor (Amount in Line 4 multiplied by state rate. ** If purchase price

$

of boat, motor, and trailer is one amount, use 90% of Line 3 for boat and motor purchase price. )

7.

Local Sales or Use Tax Due on Boat and Motor (Up to $1,600 of amount in Line 4 multiplied by local rate.

$

Local tax capped at $1,600 on each single article.)

8.

State Single Article Tax Due on Boat and Motor (Multiply portion of amount in Line 4 between $1,600 and

$

$3,200 by 2.75%)

9.

State Sales or Use Tax Due on Trailer (Amount in Line 5 multiplied by state rate. *** If purchase price of boat,

$

motor, and trailer is one amount, use 10% of Line 3 for trailer purchase price.)

10.

Local Sales or Use Tax Due on Trailer (Up to $1,600 of amount in Line 5 multiplied by local rate. Local tax

$

capped at $1,600 on each single article.)

.

11

State Single Article Tax Due on Trailer (Multiply portion of amount in Line 5 between $1,600 and

$

$3,200 by 2.75%)

12a.

State Tax

Local Tax

.

12b.

12

State and Local Tax Due on all Warranty or Service Contracts purchased on Boat,

Motor, and/or Trailer and on which Tennessee Sales Tax was not Collected (Multiply

$

$

total purchase prices by the state and local sales tax rates).

13.

Sales or Use Tax Paid in State of __________________________ (Documentation must be attached)

$

14.

Tax Due (Lines 6 - 12 less Line 13):

$

15.

Clerk’s Fee:

$

16.

Total Due (Lines 14 and 15):

$

County Clerk - If no tax due, mark specific explanation. Must attach any required information.

*

Trade-in - Enter year, make, model, and hull or VIN#

New Tennessee Resident - NOT EXEMPT on boats with a fair market value of $10,000 or more. Must pay

Gift (Attach affidavit)

tax on Fair Market Value of $10,000 or more less tax paid in other state. Complete Line 13.

Resale - Enter Sales Tax Account Number

Other (Attach documentation)

I certify that tax is paid on total consideration of boat, motor and trailer.

Signature certifies that taxpayer has paid tax on the sales price as required by Tenn. Code Ann. Section 67-6-406.

Signature of New Owner:

Date:

Name of County Clerk:

Name of County:

No.

Signature:

Title:

RV-F1303401

INTERNET (10-15)

Original Form - Department of Revenue

First Copy - Boat Owner

Second Copy - County Clerk

1

1